After having read one or both of my books (Get Me to ZERO and/or Tax-Free Millionaire), I get lots of questions from folks wanting to know how investing in a taxable brokerage account (non-qualified) compares to an IUL (Index Universal Life policy) regarding generating supplemental retirement income.

Good question. There are 1,000s of ways to properly design and fund an IUL. Here’s just one example. I’m not showing all of the proprietary IUL design here, but he had only funded $50,000 annually for seven years out of his own pocket.

Does somebody need to contribute $50,000 annually to get an IUL? No. Depending upon your age, sex, and health, as little as $1,000 per month would work better than a brokerage account (non-IRA).

Robert (age 48 and in good health) wants to invest a part of his inheritance… either in the markets or an IUL. Where the funds come is not important.

The policy premiums or market investments he makes could come from a monthly cash flow, existing brokerage accounts, a Roth-like conversion (yes, doing this can be more attractive than a typical Roth conversion), the sale of a business, selling real estate, or from any other source.

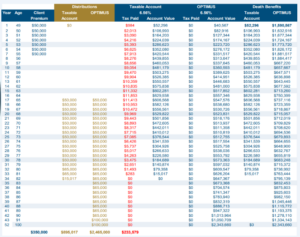

He wanted an IUL designed (the columns called Optimus) using $50,000 annual premiums for just 7 years. You can see the death benefit rising for the first seven years. That’s needed to get all the premiums in according to the tax laws. And then we drop the death benefit to the lowest the IRS will allow to maximize future income (since this was the primary goal).

You will notice that the death benefit never goes below $643,000, almost twice what he contributed.

Of course, the taxable brokerage account has no death benefit other than the actual account value. And Robert wouldn’t be paying for any mortality costs like he would in the IUL.

Then we allow the cash value to grow in both accounts until he is 65, when he would like distributions to begin. Even though the taxable brokerage account has a larger balance before distributions (due to policy expenses and costs associated with the big death benefit), the IUL will outperform by a significant amount.

In the chart below, you’ll see six sets of columns: 1) year and age, 2) contributions, 3) distributions (brown), 4) Taxable Account, 5) OPTIMUS (IUL), and 6) Death Benefits.

If you’ve read my books, you will recall that the growth inside an IUL is tax-deferred, and distributions (when you follow the simple IRS rules) are TAX-FREE.

But taxable brokerage accounts are subject to annual 1099s that report short and long-term capital gains, dividends, and interest to the IRS. Any taxes due must be paid every year.

The middle column with the figures in RED shows the annual taxes Robert might have to pay, while the IUL gains are not subject to tax. We assume both alternatives earn the same 6.56% each and every year.

With these assumptions, he will have paid around $233,000 in taxes over the years while withdrawing a net amount of about $895,000 from his brokerage account. It’s a total of $350,000 invested and $895,000 of after-tax distributions. Those figures are at the bottom of the chart columns.

Now, 6.56% may sound low for a brokerage account, but keep in mind that stocks and bonds are subject to market losses while the IUL is not subject to market losses (ZERO is your HERO!). Both Goldman Sachs and Vanguard predict that over the next 10 years, the S&P 500 will only average between 4%-6.5% and bonds something like 3%-4.5%.

Of course, nobody knows what the markets will do, but if they are right, the 6.56% assumption might actually be high for the brokerage account with likely market losses along the way.

Anyway, at age 65, he begins taking non-taxable distributions from the IUL. Again, there is no tax owed to the IRS or state. Unlike the brokerage account, these distributions also DO NOT cause his Social Security to be taxed or potentially raise his Medicare premiums. By law, they do not even show up on any tax return.

Meanwhile, taking the identical initial $50,000 distributions from the taxable account (at age 80, both distributions increase to $80,000). All or some of his distributions from the brokerage account would be taxable until he reached his basis ($350,000). Again, the RED numbers in the middle column show the taxes owed at current tax rates.

The chart shows that his brokerage account runs out of money (and therefore income) at the age of 82. It’s all gone. And before that, a dwindling account balance for his heirs. No death benefit for loved ones after that point.

However, with the IUL, if he died at age 82, his family or charity would receive a tax-free check of around $795,000 in addition to the tax-free income already received.

Meanwhile, the income from the IUL keeps going. And at age 91 (and through age 100, as shown), the income from the IUL increases to $100,000 annually. Unlike the brokerage account, none of this income has ever been taxed.

Let’s compare the total potential outcomes at the same gross crediting rates with the same $50,000 contributions for 7 years. Should he live to age 100, in his brokerage account, he will get around $895,000 of after-tax income (after paying about $233,000 in taxes along the way, until the account is completely depleted).

By the way, with over $37 TRILLION in federal debt, Social Security and Medicare are a financial mess, do you think taxes will be higher in the future?

At age 100, with the IUL, he’ll have enjoyed approximately $2.4 million in TAX-FREE distributions, PLUS a tax-free death benefit to his loved ones, of over $2.3 million. That’s about $4.7 million of total UNTAXED benefits from the IUL vs. $895,000 in the taxable brokerage account.

The IUL is a 522% better deal for Robert. That’s over five times more benefits from the same invested dollars.

Equal funding, the same returns, although the brokerage account has no death benefit beyond its account value. In fact, if Robert had passed away at any point during this chart, his family would be much better off than with the taxable brokerage account.

What if the IUL earned only 5.5% (imagine the S&P 500 without losses or dividends) instead of 6.56% for decades? The IUL would still win.

Could the brokerage account do better than 6.56%? Maybe. Could the IUL do better than 6.56%? Maybe. In any case, since 2020, I would tell you that the insurance commissioners make the insurance companies tamp down the projections illustrated here. So, in my humble opinion, the IUL could very well perform better than shown. That means Robert might be able to take more tax-free income or leave more to his loved ones.

That’s why I own six IULs (I just bought my sixth last month at age 67), and Norma owns two of them. Are IULs perfect? Nope.

Do you know any investment that is? Every single place to store your savings has pros and cons.

I just like having an asset class that has no stock market risk, is not subject to taxation at all, offers a huge death benefit for my family if something happens to me, and in some cases might even offer some long-term care benefits (although I don’t design our policies for that since we already own traditional LTC insurance).

The policy design could be even better if Robert wanted to introduce bank financing to pay part of the policy premiums… or even better, add additional funding with bank loans. In my books, readers know that I use my own name for this strategy, as Catapult plans.

If you are age 25-60 (in good health and make a very good living), you can learn more about our unique bank financing for an IUL and use our interactive calculator at: www.taxfreecatapult.com

There, you can input your age and amount of contributions (for just 5 years only) and see what tax-free income and remaining death benefit there may be through age 90. It’s fun and anonymous. For our special program, our banks have no credit application, no credit check, no personal guarantee, nor is even a signature on a loan document required. Try to get those terms at your local bank branch!

However, Robert decided he wanted to use the cash value in the policy to implement our Private Reserve strategy, which I also wrote about in those books and personally use myself. That strategy teaches folks how to have their money earn returns in TWO PLACES at once.

You’ll see that at the end of year 8, he’ll have something like $300,000 in the IUL that the insurer can loan him to make an outside investment, while that $300,000 is STILL earning index returns. Again, with no loan application, no credit check, no questions, and no repayment schedule.

Could an IUL make a significant difference in your future retirement and right now? I’m happy to help using my 20+ years of experience. Just reach out to me.

all the best… Mark