The name of my firm is PROACTIVE Tax Planning, LLC.

If you believe, as I do, that income taxes MUST rise due to the $31.5+ TRILLION of federal debt, the known shortfall in promised Social Security benefits, and Medicaid, as well as Medicare, are a financial mess, then tax planning today should be foremost in your mind.

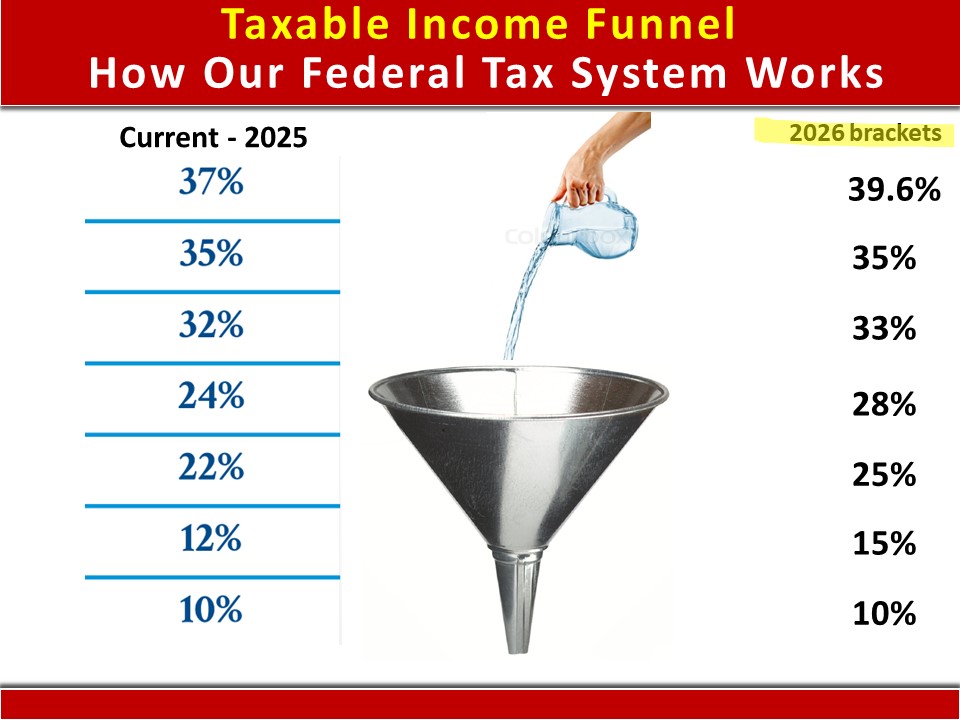

The earlier tax planning is done, the better. As tax law stands today, tax brackets are set to return to the higher 2016 levels in 2026. Unless Congress acts, this is what you can expect.

But quite frankly, it’s just a matter of time before our federal government is forced to substantially raise taxes beyond 2026 – particularly on the top 20%-30% of income earners to pay the bills and the interest (at rising rates) on our growing federal debt.

Most of my tax planning focuses on individuals using ROTH contributions, ROTH conversions, and the hundred-year-old tax benefits of life insurance, as I fully outline in my “Get Me to ZERO” book (available on Amazon in paperback or KINDLE).

However, I have some tax strategies for business owners and independent contractors to save taxes today. Although, the IRS seems to whittle down my list yearly as they narrow the taxation between W-2 employees and business owners.

Having said that, depending on the income situation of the business owner (the more income, the more options you have), there are strategies that your CPA does not know about or does not fully understand and, therefore, will never discuss with you. And you may be missing out on huge opportunities to reduce your current and even future income burden.

That’s right; most CPAs are not proactive tax planners. They document and record your taxes based on the “shoebox” of receipts you bring them. I do not prepare income taxes. Never have and never will. That’s not my strength. The worst CPA in America can run circles around me in tax preparation. No doubt about it.

There are TWO TAX SYSTEMS in the USA. One set of rules for business owners and the self-employed… and one for W-2 employees. You may not realize that as a small business owner, you benefit from capitalism fully.

But there are yet ANOTHER TWO TAX SYSTEMS in the USA that I’ve been preaching about since 2000. One tax system is for the uninformed… and the other is for the informed! Who do you think pays more in taxes for the same income?

We all need to pay our fair share of taxes. I understand that. But we do not have to pay more than we legally owe!

“We have the absolute right to legally reduce our tax bill to the lowest amount allowed by Congress,” is Judge Learned Hand’s famous quote. More about him in a moment.

I’ve been a Certified Financial Planner (CFP) for over 22 years and a lifelong entrepreneur. Since 2004, I’ve specialized in proactively helping Americans set themselves up to pay as little as ZERO taxes during their retirement. And yes, about 82% of people can actually do that!

In fact, that’s the title of my retirement tax book, “Get Me to ZERO.”

And I’ve published other books about retirement planning that still sell very well on Amazon. Readers of all seven of my books from across the country ask me for advice and pay me a fee to design a year-by-year retirement income roadmap for them… OR help them implement some or all of the seven “Get Me to ZERO” strategies.

The written words and financial planning process I espouse in my seven books have resonated with many folks. In fact, I’ve never even met 90% of my clients. They are located in about 23 states and still trust me with their finances.

There are 3 key mental shifts that you must make to be able to take control of your income taxes finally. To pay the lowest legally allowed by the IRS rules and regulations — especially during your retirement when you can least afford to pay higher taxes than you should.

I’m going to take you through these 3 mental shifts to lower your TAXES now and permanently.

Shift 1: You Need to Be a CPA to Give Top Tax Planning Advice

I can almost hear you now, “But Mark’s not even a CPA or an EA (Enrolled Agent)! How can he help me reduce my annual tax liability?”

Nope, I’m not a CPA or EA. I decided long ago that I had no interest in working 100 hours a week during tax season preparing tax returns, projecting estimated payments, making P&L projections and financial statements, bookkeeping, and other tax compliance paperwork. And I was not interested in becoming an auditor (counting widgets in warehouses or doing forensic accounting, etc.) either.

For me, that’s all absolutely dreadful and boring work. I have no interest in any of that! They can have it (and most are excellent in what they do). I’m a fee-based financial planner and have been for nearly two decades.

Unlike many tax preparers who accurately record your financial history, I prefer helping my clients write their own tax future via planning – not simply recording it.

I have tremendous respect for CPAs and their knowledge of the tax code. I’ve spent a lot of time in training sessions with CPAs (CPE credits), and I’ve been wowed by their knowledge about filing taxes, accounting, etc. They really know their stuff.

But too many are not very proactive or forward-looking. Many don’t like to venture far from their comfort zone or learn proven tax planning strategies. They are already overworked.

Even when studying the tax code with my network of “enlightened” CPAs, they will tell you that most of their peers are not proactive tax planners. They’ll tell you that the extent of “tax planning” for many of their fellow professionals is “Did you max out your 401K, SEP, or IRA this year”? That’s not saving taxes; it’s only postponing them into the future at unknown tax rates, brackets, and deductions!

And if you really want to “postpone” paying your taxes, there are much bigger ways than a SIMPLE, SEP, or 401K to save (delay) your taxes on $100,000s of profits each and every year! Anyway…

According to the Tax Simplification Group (US House of Representatives), every year, Money magazine asks 50 different tax preparers to prepare a 1040 tax form for a sample family. Seldom do two preparers arrive at the same result! Forty-four different tax bills!

And that’s for a simple individual tax return! Imagine the “taxes due” disparity of filing a much more complicated business return. The results would be all over the map!

According to Forbes magazine, “93% of small businesses paid more taxes than they should have. That’s more than nine in 10 business owners were overpaying their taxes – regardless of whether they were paying for a high-priced accountant”.

But CPAs perform many valuable services, and they have infinitely more tax return and accounting experience than I ever will. BUT… that does NOT mean I can’t find more allowable deductions or show you advanced tax planning strategies. We almost always do.

Shift 2: Your Tax Preparer Already Has You Paying the Lowest Tax

I’m certainly not going to bash CPAs or EAs. There are so many areas that the typical CPA is awesome at, and they are lightyears ahead of my knowledge in those subjects. And when in doubt, I can always refer to one of the 50 or so “reformed” CPAs, EAs, and Tax Specialists in our national tax planning network (plus, I joined another tax-saving professional group).

FYI: Business owners. Did you realize that there are actually about 500 legal business tax deductions in the IRS Code (some 7,000 pages long plus all of the regulations, Tax Court findings, private letter rulings, etc., etc.)? That’s 500 allowable IRS deductions!

Any experienced tax preparer will have heard about (or should have) all of those valid tax deductions and some of the tax strategies that we employ daily.

But your preparer can’t possibly take the time to ask you – along with his/her other hundreds of tax clients – about every part of your business and your personal goals. They are understandably overwhelmed by the sheer number of tax returns they must prepare.

Most preparers take the information you provide them from your financial records and then put your returns in a stack with the 1-2 dozen they may crank out each day throughout the tax season. It’s an assembly line during tax season.

And truth be told, he/she is not charging you to do anything but provide you with timely and accurate tax returns. They do one return after another. Charge their tax-prep fee of $500-$1,200 or so. Next.

In addition to hundreds of available business tax deductions, there are some 18-22 advanced tax planning strategies that our national tax planning networks have studied and have at our disposal to reduce your tax liability when appropriate dramatically.

FYI: The CPA Exam consists of four 4-hour sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). They must pass all four sections within 18 months, earning a minimum score of 75 on each part to become a CPA. Like the exam for a CFP, the CPA is a tough exam to pass and is quite an accomplishment!

Advanced Tax Planning strategies are not part of the CPA curriculum. As you just read, they were not usually ever formally trained in advanced tax planning strategies, nor are they tested about them on the exam to become a Certified Public Accountant.

I am not saying that I know more about tax preparation and accounting than CPAs or EAs — because that is absolutely NOT true. However, I am saying that based on the 1,000s of business tax returns and Schedules Cs and Es our group has reviewed over the years, in almost every case, there were missed deductions and advanced tax strategies that could have been employed – saving tens of thousands of dollars (sometimes $100,000’s) over time.

And quite frankly, tax preparers (including CPAs) are no different than any other professionals (CEOs, doctors, lawyers, contractors, software coders, FBI agents, teachers, actors, financial advisors, etc.) in that there is a wide range of skills, passion, experience, and results.

Ask your tax preparer point-blank. Could you have saved me any more money on my income tax bill? Did I get every available deduction? Did you show me every potential tax planning strategy for my situation? Are you sure?

Shift 3: Paying Higher Income Taxes Than You Should Is Patriotic

Judge Learned Hand (1872-1961) is perhaps the most famous U.S. Court of Appeals Judge never to become a Supreme Court judge. According to Wikipedia, he “was an American judge and judicial philosopher.

Judge Hand served on the United States District Court for the Southern District of New York and later on the United States Court of Appeals for the Second Circuit. Hand has been quoted more often by legal scholars and by the United States Supreme Court than any other lower-court judge.”

He also said, “Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one’s taxes.”

“Over and over again, the Courts have said that there is nothing sinister in arranging your affairs to keep taxes as low as possible. Everyone does it, rich and poor alike, and all do right, for nobody owes any public duty to pay more than the law demands”. Well said, Judge Hand!

Author and tax instructor Tom Wheelwright, CPA, wrote, “After all, the tax law is really a map – a treasure map. As you follow this map, your taxes go down. We at least want to minimize them by becoming fully informed and proactively using the tax code as it is written and intended. Using our tax laws for future legal tax avoidance… NOT illegal tax evasion — is just being tax savvy”.

That’s the basis of PROACTIVE Tax Planning, LLC and its reason for existing. No matter who has been preparing your annual tax returns, you’re likely to have been overpaying taxes, thus depriving you and your family of tens of thousands of dollars for a very long time. We can fix that with proper and prudent planning.

You probably feel taxed to death (and I certainly feel that way personally)!

Here’s why. The discussion in this article is mostly about federal income taxes due to the IRS and perhaps your state. But let’s be clear; your tax bills don’t stop there. Depending on where you choose to live, you will have other taxes and fees to pay (amounts will vary by location).

TAXES are our #1 overall expense to live in the USA. Here is just a partial list of your after-tax income supporting various government entities:

There are state and local income taxes, FICA taxes, real estate taxes, sales taxes, personal property taxes, car registrations, business licenses, excise taxes (for gasoline, alcohol, cigarettes, sodas, hotel stays, airlines, and many other items), tolls, licenses (driving, hunting, fishing, marriage, bikes, pets and so on) and special fees for courts, construction permits and dozens more. We are taxed and taxed again!

We can’t do much about these except choose where we live. But states with no income taxes usually have higher property and sales taxes. We can’t get away from paying most of these fees and taxes.

But we CAN do everything legally possible to reduce our federal income (and state) tax burden! So, let’s keep on trying to do that, OK?

We’re going on a treasure hunt, and I assure you we will at least come up with one chest of silver… if not two or three chests of gold – every year going forward!

The IRS is not going to help you save tax dollars. The IRS will never inform you about a tax deduction/strategy you could have taken. It’s all up to you! Former IRS Commissioner Mark Everson famously said, “If you don’t claim it, you don’t get it.”

Getting uncomfortable and putting some skin in the game creates a real transformation. Without skin in the game, the motivation to SAVE TAXES does not last.

The cost of not doing it is always more than the investment needed. Always.

You probably shouldn’t only rely on your tax preparer to give you good tax-saving strategies and additional (100% allowable) deductions to keep more profit in your pocket.

ROTH contributions, conversions, and life insurance are the three easiest ways to get a tax-free retirement or get as close as possible. There are a few more that I write about in my Get Me to ZERO book

That… it’s our constitutional right as Americans to reduce our tax bills to the lowest allowed by law. That’s legal tax avoidance – not tax evasion! That’s been proven and upheld in the courts repeatedly. You don’t get brownie points or extra credit for overpaying the IRS!

Let’s assemble a tax plan as part of a written retirement income plan to give you the most tax-efficient, safe, and predictable retirement possible.

I look forward to hearing from you… Mark

Investment Advisory Services are offered through Retirement Wealth Advisors, Inc. (RWA), a Registered Investment Advisor. Mark J. Orr and RWA are not affiliated. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss during declining values. Opinions are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

This information is designed to provide general information on the subjects covered; it is not, however, intended to provide specific legal or tax advice and cannot be used to avoid tax penalties or to promote, market, or recommend any tax plan or arrangement. Please note that Mark J Orr and its affiliates do not give legal or tax advice. You are encouraged to consult your tax advisor or attorney.

Life insurance and annuity guarantees rely on the issuing insurer’s financial strength and claims-paying ability. Any comments regarding safe and secure investments and guaranteed income streams refer only to fixed insurance products. They do not refer in any way to securities or investment advisory products. Fixed Insurance and Annuity product guarantees are subject to the claims‐paying ability of the issuing company. They are not offered by Retirement Wealth Advisors, Inc. All life insurance and annuity products are sold separately through Mark J. ORR, CFP, RICP. PROACTIVE Tax Planning services are also offered separately through PROACTIVE Tax Planning, LLC.