The market didn’t give us the traditional end of year “Santa Clause” rally and 2015 hasn’t exactly started out with a bang (the worst start since 2008).

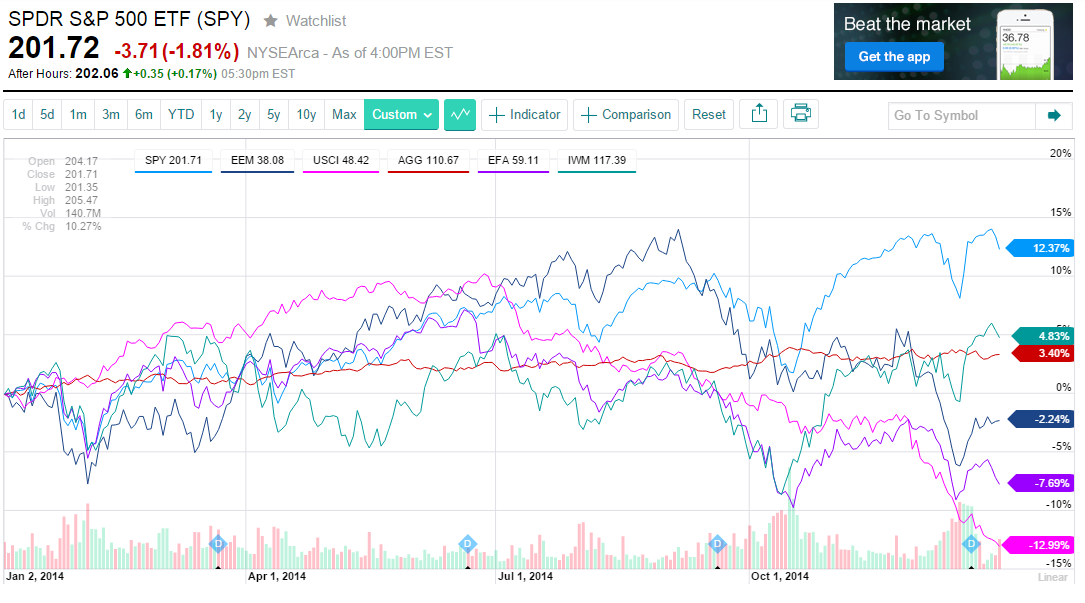

About 3 weeks ago, I sent out an email entitled something like “Is the market REALLY at all time highs?” Basically what I wrote and showed with an attached chart is that only the S&P 500, DOW and Nasdaq really had a great 2014. These indexes are dominated by a few mega cap stocks like Apple, Microsoft, VISA, 3M, etc.

But most investors are not just invested in the big US cap stock indexes. Most investors are wise to diversify with small US stocks, US bonds, international stocks and bonds from both developed and emerging markets around the world, commodities etc.

SPY – S&P 500

EEM – Emerging Market index

USCI – US Commodities index

AGG – US Bond index

EFA – International Stock index

IWM – US Small Company index

So yes, the big cap indexes had another great year with 12% (S&P 500) or so returns. But unless you were fully invested in just those indexes, your own returns likely lagged “the market”.

I’ve attached the full 2014 chart (updated to 12/31) that shows how some of the other indexes like bonds (up 3.47%) and international stocks (lost 6.46%) fared over the past year.

Once you CLICK on the chart, click it again to make it larger. Investors with a “diversified” portfolio likely ended the 2014 year with total returns in the 4%-7% range with a ton of volatility during the last 12 months.

And the Wall Street Journal reported that 79% of all mutual funds did worse than their benchmark, so no matter how you invested you likely lagged the benchmarks in this manner as well

It’s my belief that 2015 will offer good returns in the S&P 500 despite the rising dollar and both Europe and China slowing down. Perhaps up by 8-10%. But I also think that there will be more frequent and harder temporary drops in the market too.

Enjoy the attached chart (SEE BELOW)… Mark