As most of you know, the stock market for 2016 got off to the worst start of a new year – ever!

But since the bottoming (so far?), a few weeks ago the market has come roaring back. Does this mean that the worst is over and that we’ve got a green light for the rest of the year?

I’m not so sure and neither are the 3rd party private wealth managers that I use in managing the moderate and higher risk buckets. But over the recent market drop most have been in cash or safe bonds to protect our investor’s capital as best as they could.

Before I get started, let me say that I am not predicting the next -30%, -40% or -50% drop in the market anytime soon. Although many “experts” would not be surprised if what we’ve seen so far since the summer could grow into a much deeper and longer bear market.

The point of this BLOG is to show you what happened before, so you won’t be surprised in the future with huge gains “within” a bear market. Some bear markets are of longer duration, some are shorter. Most are not quite as deep as the one in 2000-2002 and the bear market described here. But they all share the “false” endings that are so clearly shown in this blog post.

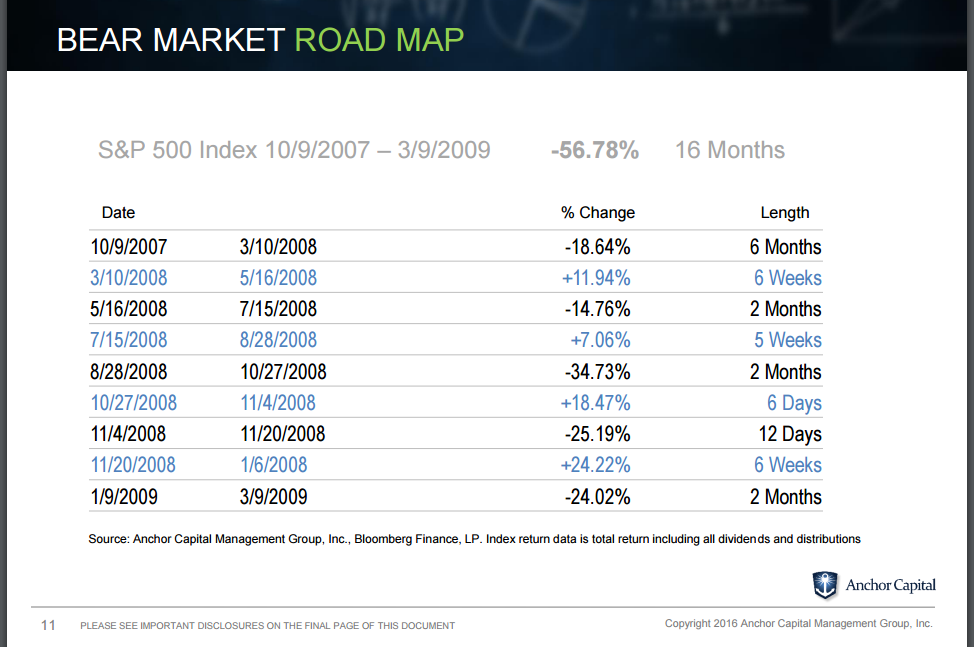

Below you’ll see a chart that one of the managers shared with us on a conference call this week. It shows how the great 2008-2009 bear market (the worst since the Depression) happened – all of the ups and downs within that stomach-wrenching period.

From the S&P 500’s peak on 10/09/2007 until its absolute bottom on 3/9/2009 the index dropped a total of -56.78% (from top to bottom). But as you will learn from the chart below, that huge drop over some 16 months, was not straight down. Let’s look at how it progressed over that time period.

In the first 6 months (from 3/9/07 to 3/10/08) the index fell -18%. But in the next short 6 weeks, the index gained back +12% by May 16th. Surely it looked as if the bear market died an early death. It looks very similar to what has happened in the end of 2015 and early 2016 – a very meaningful drop followed by a quick “recovery”. But although I have no idea what’s going to happen next now, that awful bear market did not stop there.

Over the next two months (from May 16 to July 15) the S&P tumbled over -14%… giving back all of the recent “gains”. Then, over the next five weeks, the market gave another head fake by adding +7% before its biggest fall of the bear market. Who knew?

In just 2 months, from Aug. 28 2008 to Oct. 27, 2008, the index plummeted over -34%. That’s a drop of over one third of market value in only 60 days. But the excitement didn’t stop there.

There was a huge SIX DAY “bear market rally” where the index soared by nearly +18.5%. In just 6 days! Was the bear market finally over? Well since you probably peaked at the chart below you know that there was still more pain to come.

The roller coaster ride continued over the next 12 DAYS with the index dropping like a rock… down -25%!

Then there was one more relatively quick climb (up +24%) over the following six weeks until my daughter’s birthday on January 6th, 2009 (there is a typo on the chart).

Then the market would work its way downward (another drop of over -27%) during the next two months and FINALLY bottom out on March 9, 2009. As you can see it was a dizzying and painful 16 month journey from peak to trough of over -56%. Interestingly, that final market bottom was exactly 7 years ago from today!

Now I certainly have no idea if 2015 and 2016 is going to repeat any of that history. Of course nobody does. But I do know that our 3rd party private wealth mangers all had a great 2008 and 2009 – because they either went to cash and some can even profited from market drops. They seem to have more problems with markets that have no trends and are flat like 2015, than the more normal “trending” up or down markets.

As you all know, past performance does not predict or foretell future performance, but between the dozen or so manager strategies, I feel pretty confident that my clients will be protected from the worst while capturing much of the gains.

As I’ve said for years, “that there is much more opportunity in protecting folks from the losses than trying to pick the winners for them”! And that is especially true for folks in or near retirement.

all the best… Mark