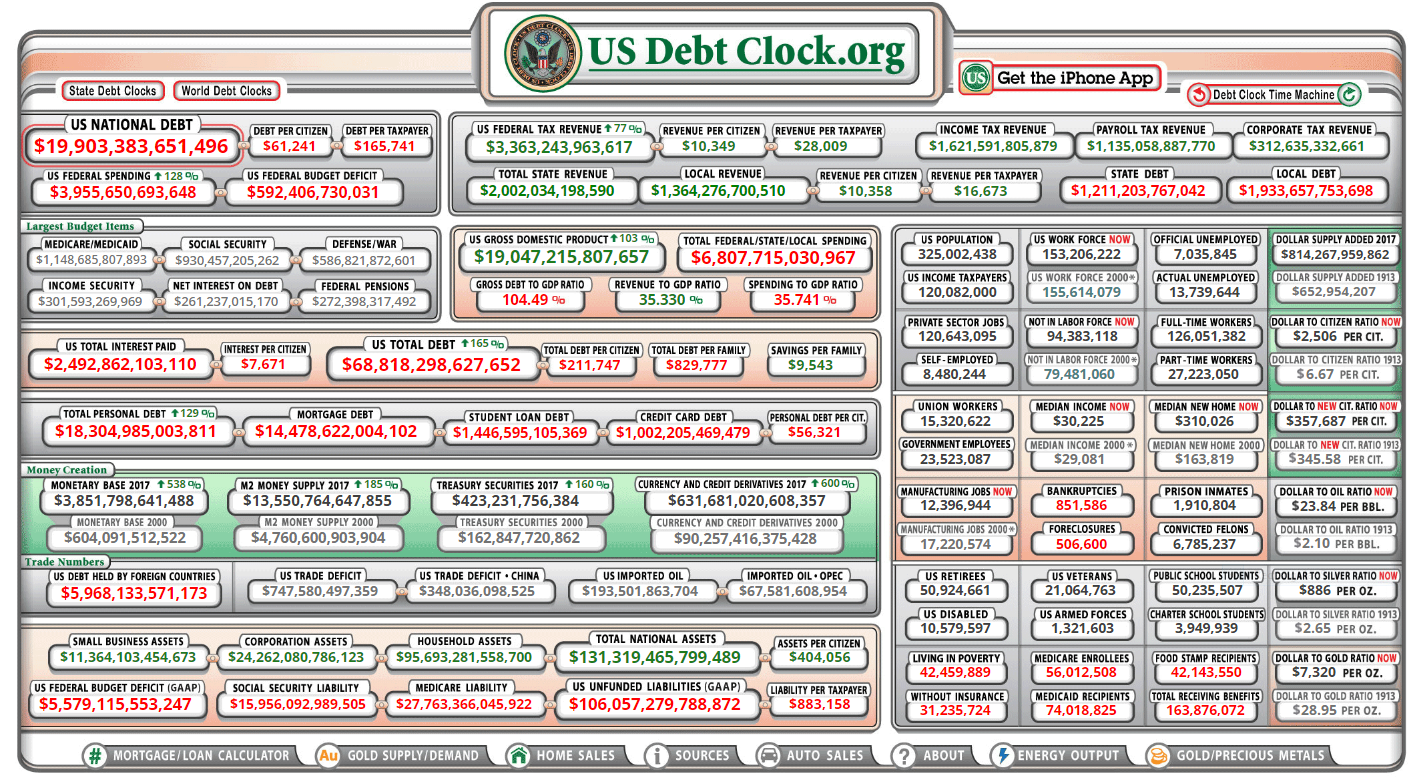

On May 9, 2017, I took an image of the US Debt Clock website. The number in the upper left hand corner is the total US National debt. The number is over $19 TRILLION dollars. That $19+ Trillion figure equals over $61,000 for each US citizen and more importantly over $165,000 per US taxpayer. You do know that something like 50% of the income earning Americans do not pay any income taxes, don’t you? It’s absolutely true.

(That $19 Trillion excludes un-funded Social Security, and Medicare obligations which adds another $46 TRILLION to our nation’s obligations. Then there’s un-funded Medicaid and Federal employee benefits which add TRILLIONS more).

I understand that it is hard to see the numbers above, but you can see the up to the second real numbers at any time by going to the USDebtClock.org website. It’s an eye-opener.

Without getting into politics, the Federal Debt doubled during the Obama years. It also doubled during the George W. Bush years. And as Americans live longer, the un-funded liabilities of Social Security, Medicare, Medicaid, federal and military employee pensions and benefits, etc. will likely only accelerate.

The next chart is a history of the top marginal tax rates from the year 1913 (a supposed one year only “temporary” tax to help pay for World War 1) through 2016. The pdf at the very bottom of this BLOG post shows a year by year from 1913-2016 of not only the top and bottom income tax rates… but more importantly the respective tax brackets!

What do I see when I look at the chart? I see that income taxes are probably on sale right now! But that’s just my personal opinion and not a professional prediction.

When I ask a room full of people at a workshop whether they think taxes are going to be higher in the next 15-25 years or lower, what do you think is the overwhelming response? What is your own personal opinion?

In my own experience and every single colleague that I have spoken to across the country, has experienced in a similar situation is the crowd says “higher income taxes”.

Now there has been a bit of excitement since the Trump election about the prospect for lower taxes. As I write these words in May 2017, it doesn’t appear that there will be major reductions in the tax rates (and no discussion at all about the level of tax brackets which are just as important) – except for the very wealthy and big corporations. We’ll see.

But no matter what happens in the next 4 or 8 years, tax rates, brackets, deductions, etc. are always in flux over time (different Presidents, Congress members, etc.) and with all of the national debt and un-funded obligations, that money has to come from somewhere and the odds are pretty high it’s going to come from the 50% of the people that are paying taxes already. You and I.

So which is more important, tax rates or tax brackets? They BOTH are critical in determining your federal income tax bill.

I’ll give you a few examples of how Congress can change not only the tax rates… but the tax brackets that apply to them. Sometimes changing the brackets is more effective in raising taxes – without raising tax rates!

After finishing reading this BLOG post, CLICK the purple link below (tax rates brackets) and take a few minutes and look at the year by year list of how one or both of those tax “inputs” can change… and change pretty quickly! What a taxation roller coaster!

In 1941 the lowest tax rate was 10% and the highest tax was 81% on taxable income over $5 million. Not too many folks were taxed at that rate as you can imagine. But the next year, in 1942, the lowest rate was raised to 19% and the highest rate was increased to 88%. But the BIG change was to the bracket for that highest rate. It was reduced from $5 million down to $200,000! That caught many more people paying that obscene tax rate.

In 1981 the top tax rate was 69% on taxable income over $215,000. The next year, the rate dropped down to 50% but on all taxable income over $85,600!

Check out the year by year list below. It’s pretty fascinating!

All the best… Mark