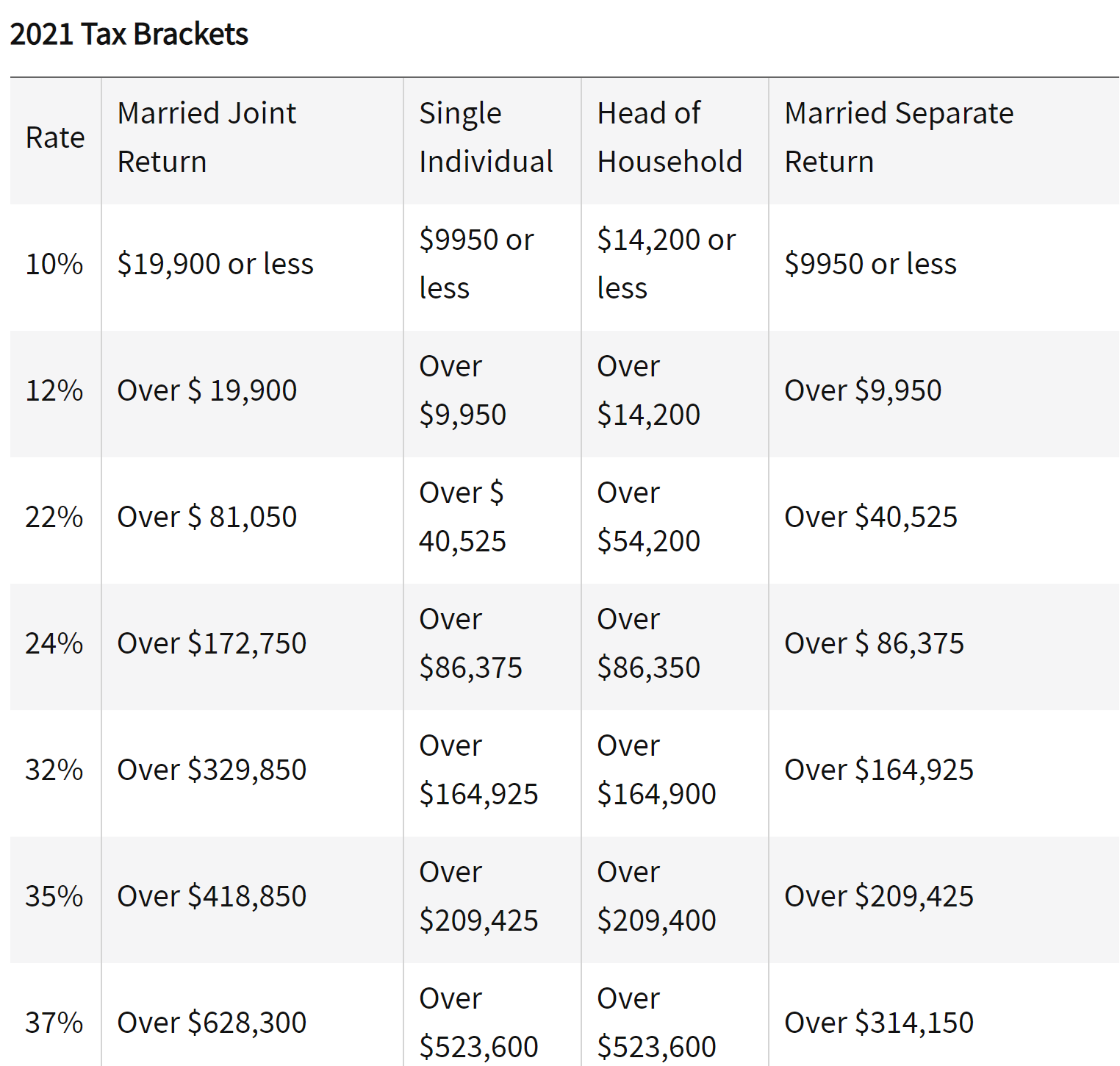

See the new tax bracket table for 2021 at the bottom of this post.

The standard deduction for married filing joint has been increased to $25,100 and $12,550 for single filers.

For those of you still working and making your FICA (SS and Medicare payroll contributions) will be applied to more of your income in 2021.

The maximum amount of income that will be subject to FICA taxes will be $142,800 (up from $137,700 in 2020).

As I wrote a week or so ago, Biden would like to increase FICA contributions for those who earn more than $400,000. But that remains to be seen.

If the recently announced Social Security 1.3% COLA (Cost-of-Living) adjustment was a disappointment, the Medicare Part B premium increase of 2.7% was a relief.

Twisted logic though this is—clearly, the rise in Medicare premiums is outstrippingSocial Security’s ability to keep up with it – it could have been worse.

In their 2020 report, the Medicare trustees projected an increase of 6%. So, we’ll take the 2.7%!

The Part B premium for 2021 will be $148.50 For most retirees), up $3.90 from the 2020 premium of $144.60.

The 2021 Social Security earnings test for those getting S.S. checks (before

their FRA -full retirement age) and still working is now $18,960 per year.

Earnings over that amount, S.S. recipients under their FRA will “lose”

$1 of benefits for every $2 over that amount.

Those are some of the highlights of Medicare, S.S. and tax brackets.

all the best… Mark