No place to put your money is perfect. Every single type of investment has pros and cons.

Most of you know that I am a big fan (where appropriate) of Index Universal Life (IULs) policies. I personally own 5 and Norma owns 2 policies. So do my daughter and brother.

I wrote a whole book about them: “Tax-Free Millionaire” which is available on amazon in paperback and KINDLE.

You don’t have to like life insurance. You only have to like it more than you do paying income or estate taxes to the I.R.S!

One of the policies that Norma and I each own (which has its own pros and cons) has a “NO-CAP” S&P 500 index option (among other index options). The catch is that you only get all gains in the index over 8.5%. So when the index has a super great year, you can earn big gains.

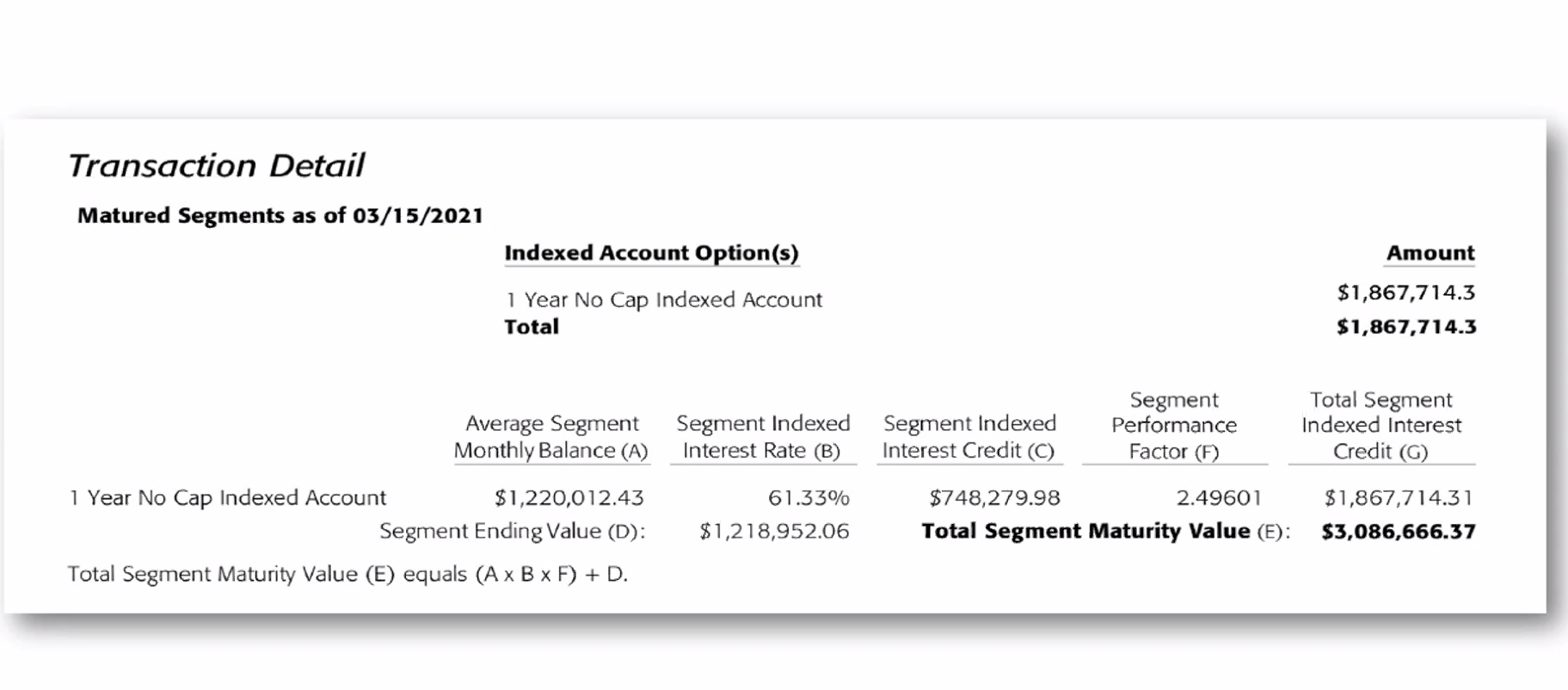

See the 1-year gain of over 61% of one policy below. It’s almost unbelievable – but absolutely true.

This policy ALSO has an optional multiplier which multiplies your gain by 2.496 times. The “catch” to this provision is that you have to pay a 7.5% fee to buy more options (upside). Again, it’s up to you each year whether you’d like to buy more upside or not. For sure, it would be attractive for a year or two after a big market crash like the short-lived COVID crash in March 2020.

So let’s go through this snapshot from a colleagues’ actual client annual statement right below:

Most of my clients don’t have $1 million inside of a single policy, but the math would have worked the same whether there was $50,000 or $150,000 of cash value in the IUL.

Granted the timing could not have been any better, since the COVID market lows of March 15, 2020, the S&P 500 index rose about 75% (trough to peak). In fact, the timing was pure luck.

As you can see, this client’s cash value in this account began its policy year with $1,220,012.

You can also see the uncapped index earned 61.33% from March 15, 2020 to March 15, 2021. That’s awesome – but it got even better for this client!

They had opted to pay the 7.5% fee to buy more upside and get any index gains multiplied by 2.496. So by paying that fee, rather than just getting the $748,279 interest credit, they got a whopping $1,867,714.31 added to their policy as interest for the year.

That’s a total gain of 153% (with the optional multiplier) to the cash value in a single (lucky) year! But an actual 153% dollar gain nonetheless.

And that means the tax-free death benefit went up by about $1.8 million as well!

And the beginning cash value for the following year’s gains is $3,086,666.37 (not the $1,220,012 from March 2020).

Not too shabby for a policy with a 0% index floor (except for the optional 7.5% fee to buy more options and upside).

You may know that in any insurance “indexed” product (annuity or life), those gains are LOCKED-IN and can never be lost to future market losses or crashes.

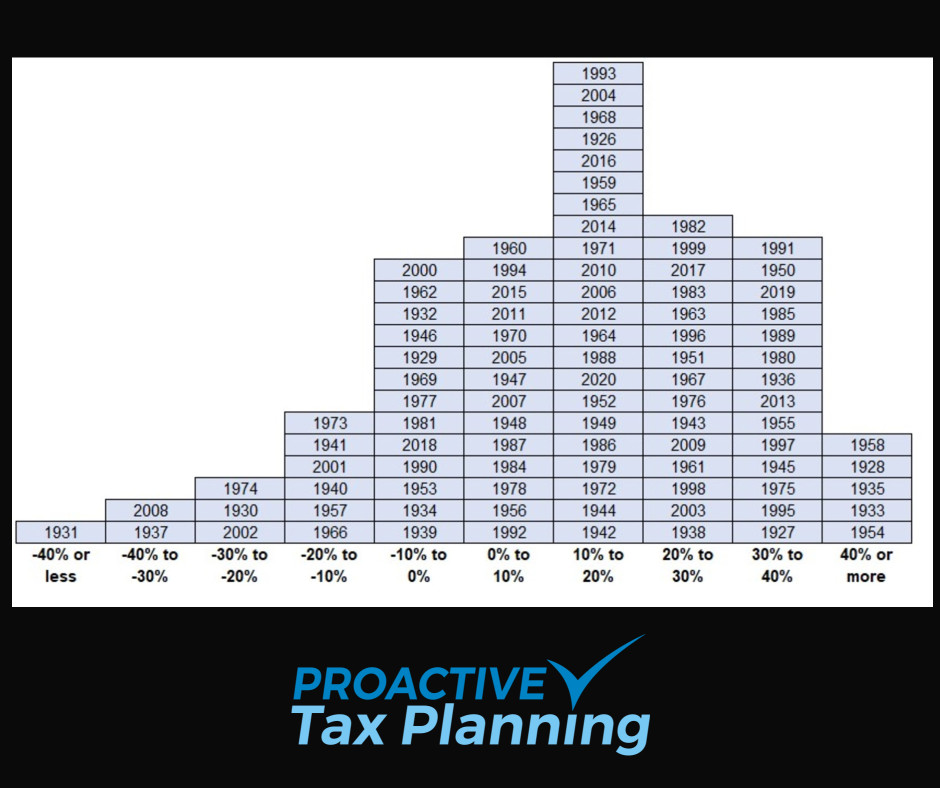

Granted, a 61% gain in the S&P is NOT normal. But 20%, 30%, and 40% calendar annual gains have and do occur as you can see below.

This policy and its design are not for everyone. It’s much more aggressive than most (but still with the 0% floor). And in fact, the new insurance regulations in effect from December 2020, I can’t even illustrate it to new clients.

But illustrations don’t matter – only actual gains in a policy. Gains that are real spendable money.

Unfortunately, this policy is not offered as a CATAPULT plan… BUT it is available to use with the PRIVATE RESERVE strategy (see my last blog post for more info on both strategies).

Norma and I each have another IUL which offers an option to boost the capped gain of an index by 40% for an optional fee of just 1%. So if the index went up 10%, your interest credited to your account (real money before policy expenses) would be 13%. (10% times 1.4 minus the 1% fee). Again, not bad for a product with a 0% floor.

Over time, I expect IULs to earn an average of 6.5% to 8% annually (not 61%). That’s a TAX-FREE average return – with ZERO market risk.

Finding the right policy and design is what I’ve been doing for almost 20 years for my clients.

Is an IUL right for you or someone (like adult children) that you care about?

The younger folks can fund a policy with as little as $500/month as a ROTH IRA alternative.

Contact me to explore this and see if an IUL can improve your life today and during retirement.

all the best… Mark