You may have heard that the Social Security COLA (Cost of Living Adjustment) for 2020 is 1.6%. That means the average American’s SS check will be $1,503 next year (that’s $24 up from last year’s $1,479 avg. check).

The maximum SS check for those retiring at Full Retirement Age (FRA) in 2020 will be $3,011. Of course, for those who delay taking benefits after FRA can get 8% per each year of delaying until age 70. There is no advantage to delaying past age 70 at all. The maximum age 70 monthly checks for 2020 is $3,790.

But those are the Gross amounts of SS checks – BEFORE the Medicare Part B and part D deductions. Part B premiums are going up to $144.20 per person per month (up $9.10 from 2019 – that’s about 6.6%).

So the gross check will be up 1.6% — BUT the Medicare Part B deduction is going up 6.6%!

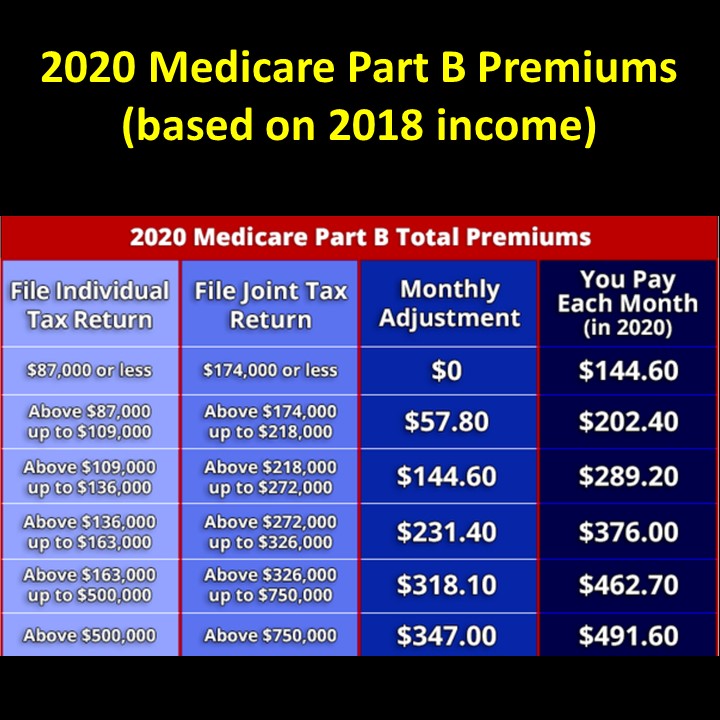

For folks with high retirement income, Medicare Part B deductions will be even higher. See my chart below (2020 deductions are based on 2018 income – there’s always a 2-year lag).

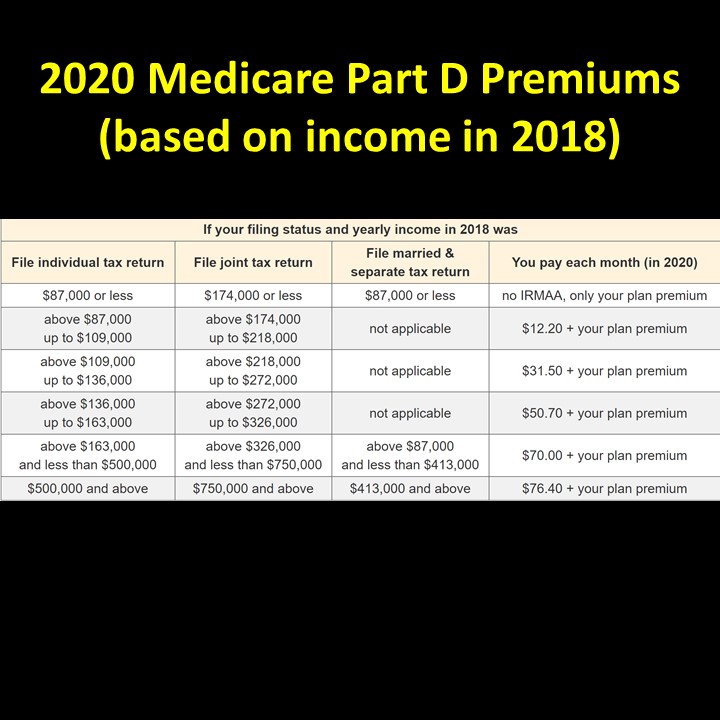

I’ve also included the (2020) chart for Part D (prescription medications) for you as well.

For those of you who are still working and paying FICA taxes (to fund Social Security and Medicare), the amount of wages subject to SS’s portion is now $137,000 (up from $132,900 in 2019). Let me expand on that a bit!

FICA taxes that are withheld from your paycheck for Social Security of 6.2% on all earned income up to $137,700 and 1.45% for Medicare (on unlimited earned income) for an employee. Your employer pays the same amounts.

If you are self-employed like me (you have no employer), you’ll pay 12.4% for Social Security on the first $137,700 of earned income and 2.9% on all earned income (no ceiling).

But there’s more! Also, as of January 2013, individuals with earned income of more than $200,000 ($250,000 for married couples filing jointly) pay an additional 0.9 percent in Medicare taxes (over and above the 1.45%/2.9% share.

The Standard Deduction (for those who don’t itemize) will be $12,400 filing as a single, $18,650 (head of household) and $24,800 (filing jointly). For those 65 or over there’s an additional deduction of $1,300 per person or $1,650 if single.

For those of you who like to postpone taxes, 401Ks, 403Bs, TSPs etc. allow for $500 contributions (the ROTH versions too). There is no change in IRA contribution limits for 2020.

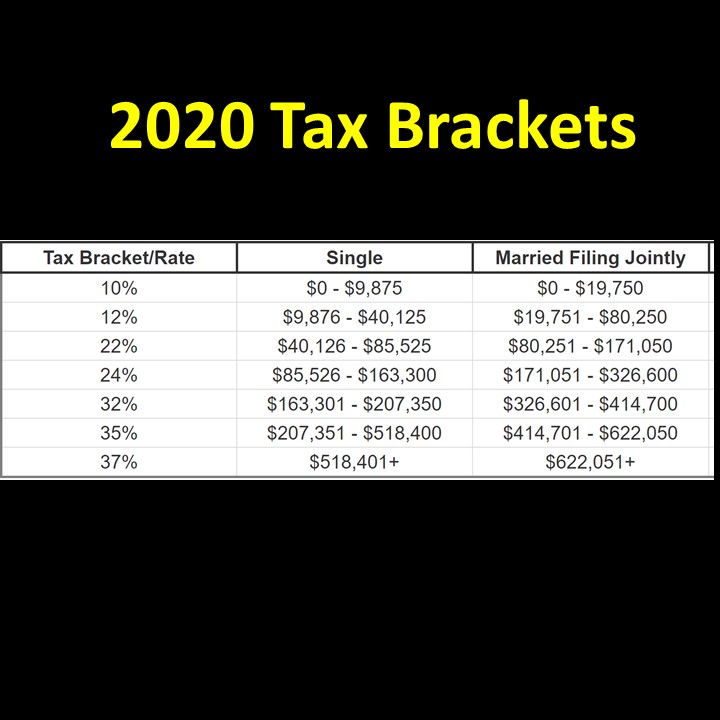

And finally, here are the 2020 Tax Brackets!

All the best… Mark