Many of you know that I personally invest a very substantial amount of money every year into my five life insurance policies that were built to accumulate cash and provide me with tax-free retirement income. This is important to me as I believe that is not “if” but “when and how much” income taxes are going to have to rise in the future to pay our nation’s $19 TRILLION debt plus unfunded Social Security, Medicare and Medicaid.

Although I do not get a tax deduction for my annual contributions, I believe I get many more “living” benefits than a 401(k), SEP IRA, etc. So I don’t have to wait to die, before personally benefiting from my policies.

The type of policy that I favor gives me double-digit gains when the market does well and protects me from all market losses during crashes and recessions. My worst annual return would be a zero when the markets crash again. I also get tax deferral along the way and tax-free access to my savings whenever I want it. In fact, once I’ve built some cash value in the policies, I can make money in two places at once. So my savings can work twice as hard for me than money in a 401K.

Many of my clients own these types of policies as well. They are called Index Universal Life (IUL) contracts.

Some people think they are only for the young. But depending upon one’s circumstances and goals, they can even be attractive for 80 year olds too. Here’s a small example.

About a year ago I had an annual client review with a 70 year old couple I had been working with for the last 6-7 years. Each of them have a guaranteed lifetime income annuity that holds a good portion of their IRA money with me, and they have an Index Universal Life (IUL) on the husband. Two of my books are written about IUL’s and how they can be used in retirement planning for folks of all ages and various financial goals.

By the way, I wrote this BLOG post a few months ago and forgot to add it to my website and email it to everyone. So here it is:

His IUL is a small policy. I built it to hold a maximum $40,000 of non-qualified money (non-IRA type money) with a death benefit of $100,000 on a 64 year old six years ago. They funded the policy sporadically… not exactly the way I designed it.

They were “supposed to pay” was $9,000 for 4 years = $36,000 and the last payment in year 5 was supposed to be $4,000. It was designed to be as efficient as possible.

But the policy premiums are very flexible. They put the $9,000 in the for first year, then $8,000 the second, nothing in year three, then $18,000 in year four, and never put another dime into the policy.

So they put $35,000 in the contract that was designed to hold a little over $40,000 over the last six years.

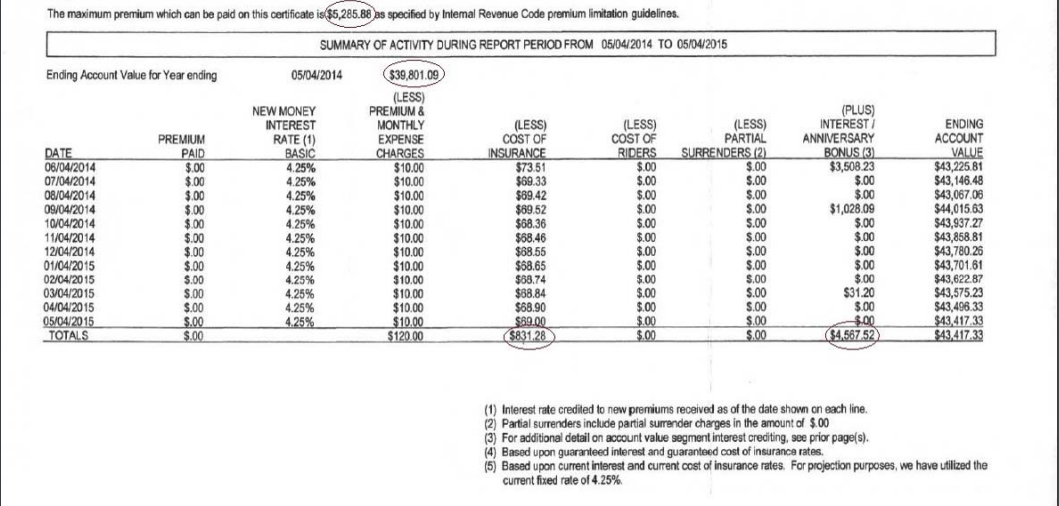

If you look at one of the pages of their IUL policy statement BELOW, you can read the sentence that reads “The maximum premium which can be paid on this certificate is $5,285. That is the amount to finish maxing out the contract to make it as efficient as it was originally designed.

You can see the ending balance of the account value for 5/2014 is $39,801. At the bottom of the last column you can see the ending balance for 5/2015 is $43,417. After subtracting the $951.28 of total policy expenses, the NET GAIN in the contract is $3,616. That equals a NET 6.7% gain during the last policy year. There are no taxes due on this increase either!

Another important thing to notice on this page o4 of the statement, is the monthly Cost of Insurance column.

Notice the cost of insurance started out at $73 and ended the year at $69 per month. This blows up the “myth” that IUL’s are way too expensive for 70 year olds, because they get more expensive as they get older.

The truth is, they become less expensive as the policy becomes efficient. This policy wasn’t even funded as efficiently as it should have been, yet it still ends up being a pretty efficient contract.

The annual cost of the Cost Of Insurance (COI’s) plus the monthly expense charges total $951.28 for a $100,000 life insurance policy that allows the owner to grow money without risk, and they can access it tax free.

During the annual review the client asked me could he put some more money in his Life contract? I told him he could put the last $5,285 in the policy, and he was disappointed that was all he could put in the contract after understanding his latest statement. But, they decided it was an easy decision to place more money into the policy.

This $100,000 policy on a 64 year old who is now 70 years old has been an excellent place for the client to put his “safe” money over the last 6 years.

Depending upon one’s financial goals and circumstances, when you build the life contract correctly, and fund it properly, an IUL contract should be worthy of consideration — no matter your age.

all the best… Mark