To start the year the market has turned more volatile while it deals with geopolitical and monetary policy uncertainty. In the last few days, I’ve had 3-4 clients express concern over what has been happening in the markets so far in 2022. I’m sure there are others who are thinking about reaching out to me to get more defensive.

That’s absolutely understandable. But let’s put some perspective on the current market correction. The large-cap S&P 500 closed in correction territory on Feb. 21, 2022, with a drop of 10% from its 1/3/22 high, and it proceeded to immediately drop another 1.77% today (Feb 22, 2022). It’s now down -11.9% from all-time highs.

With the invasion of Ukraine, the market opened down another 2% or so. As I write this blog, the market has recovered a bit from the earlier lows.

Challenges happen in markets and are something that we plan for when we construct diversified, risk-appropriate portfolios. But let’s pay more attention to the facts than emotion.

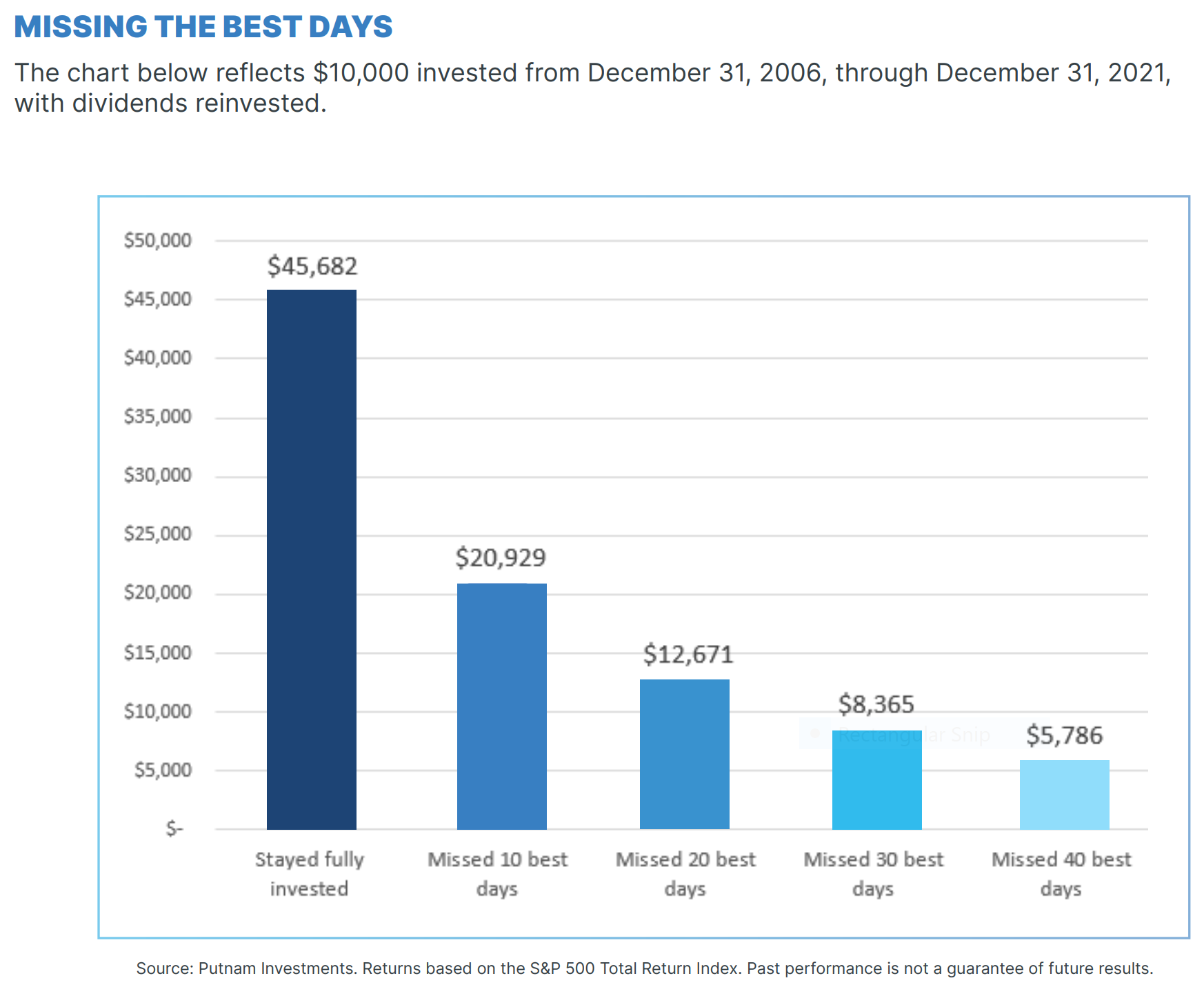

Market history demonstrates that shortly following the market’s worst days are its best days. It may be tempting to try to miss the worst days, but in the long run, it might be a risky strategy that exposes an investor to missing the best days in the market!

But this chart says it all. Going back over the last 15 calendar years, if you stayed fully invested vs. missing just the 10 best days. Being out of the market for just 10 days out of roughly 3,000 days the stock market was open during that period. You would have missed out on about 54% of the S&P 500’s total gain over the 15 years.

Look at the pitiful results of being out of the market during its best 40 days (just 1.33% of the time). You would have only gained about 12% of the returns of staying fully invested.

I don’t think the world is coming to an end. I don’t think the invasion of Ukraine will cause a recession. Yes, gas prices will rise even more which will add to inflationary pressures.

Don’t hesitate to reach out to discuss your portfolio(s). But this too shall pass.

all the best… Mark