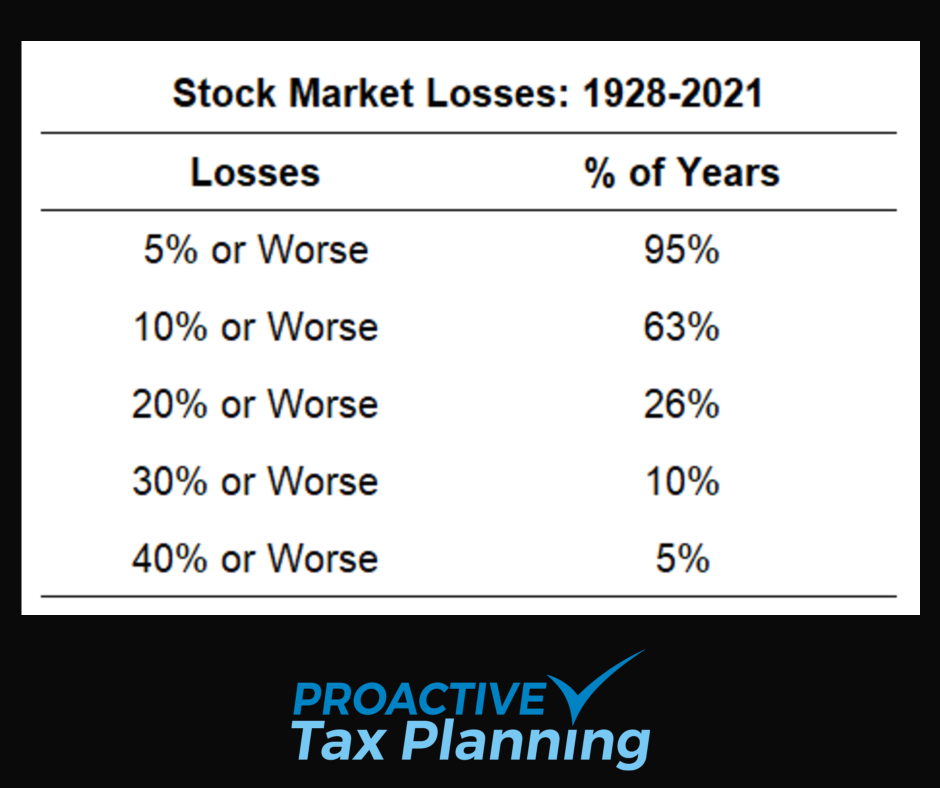

Some important facts to put losses in the stock market into perspective.

The average drawdown (loss) from peak-to-trough in a given year in the U.S. stock market going back to 1928 is: -16.3%.

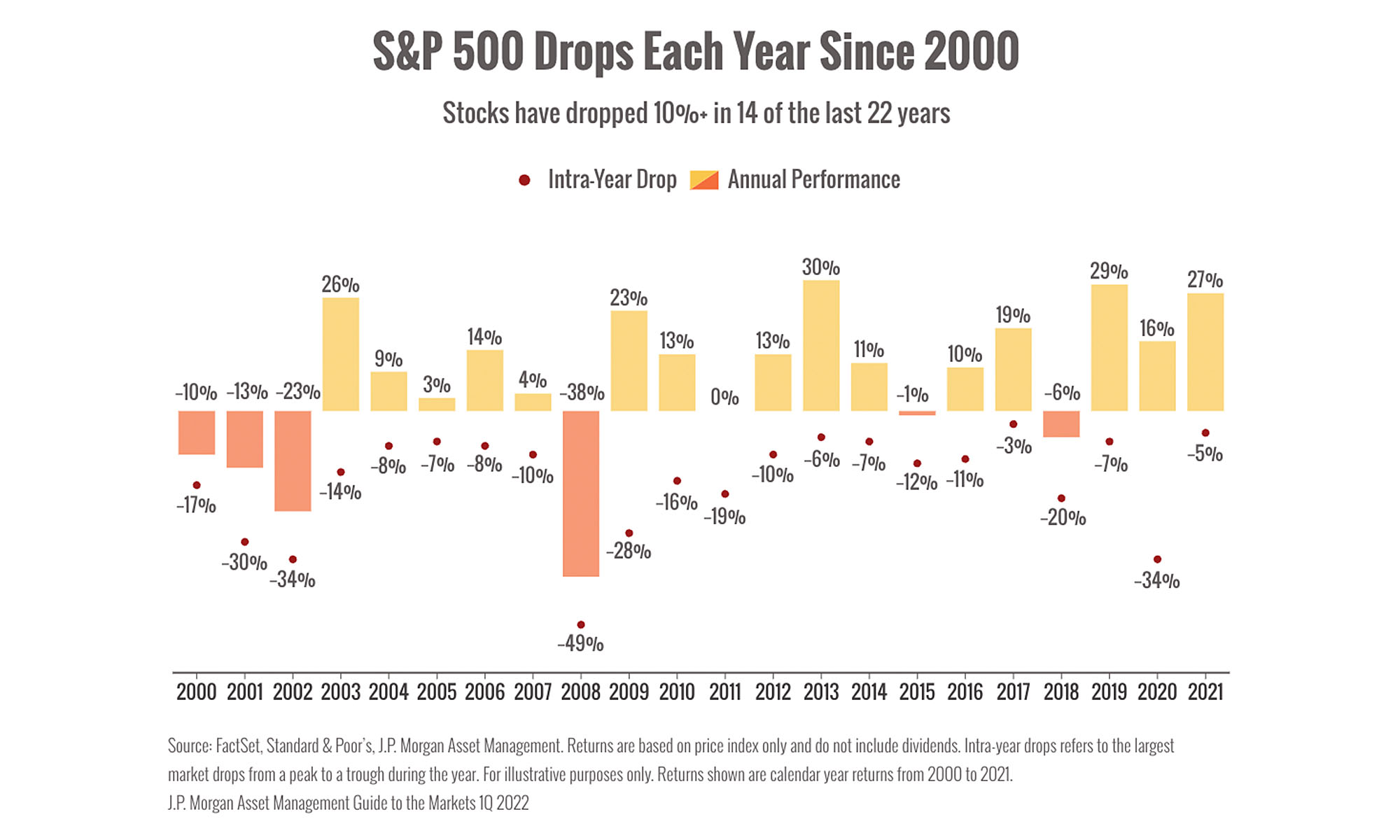

And you can see from the image below, about two-thirds of the time there has been a double-digit correction (-10 to -20%) at some point during the calendar year:

These averages are skewed a little higher because of all of the crashes throughout the 1930s, but even in more modern times, stock market losses are a regular occurrence.

Since 1950, the S&P 500 has had an average drawdown of -13.6% over the course of a calendar year.

On average, the S&P 500 has experienced:

a “correction” once every 2 years (10%+)

a “bear market” once every 7 years (20%+)

a “crash” once every 12 years (30%+)

The Nasdaq has also experienced much deeper crashes than the S&P 500.

For example, during the nasty 1973-1974 bear market when the S&P 500 fell 48%, the Nasdaq tumbled -60%.

And when the S&P got chopped in half by 50% during the 2000-2002 crash, the Nasdaq was down a whopping

-78%.

Small-cap stocks are also far more volatile than large-cap stocks (but have greater returns over the long term).

The Russell 2000 Index of smaller companies goes back to 1979. In that time there have been 22 corrections, 12 bear markets, and 7 crashes.

This means, on average, the Russell 2000 has experienced:

a “correction” once every 2 years (10%+)

a “bear market” once every 4 years (20%+)

a “crash” once every 6 years (30%+)

Of course, these things don’t occur on a set schedule but you get the idea.

One more thing. Although I believe that almost everyone should have some percentage of their savings in the stock and bond markets (diversified), my clients don’t have to WORRY about any market risk with the parts of their retirement funds in either a guaranteed lifetime income fixed indexed annuity or BUFFER Annuities (click the link to go to amazon books for your copy).

Both of which protect your principal and even allow you to profit from market drops.

all the best… Mark