Not a cheery topic by any means. But it’s one that, as a retirement income planner, I have to deal with almost every single year.

Besides the obvious, I’ll focus on just income taxes and Medicare Part B and D premiums after a spouse dies. It’s not pretty.

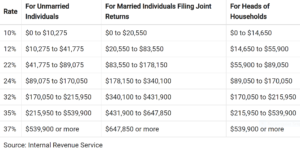

Let’s say that this 72-year-old couple is enjoying a modified AGI of $181,000. With the standard deduction of $28,700 (2022), their taxable income is $152,300. That means they’ll pay taxes to the IRS of $24,700. We’ll ignore any potential state/local income taxes for this example.

But let’s suppose the husband died in 2021, and now she is filing as a single taxpayer. Let’s take a look at what her taxes would be.

She inherited her late husband’s IRA and joint brokerage accounts, so the Required Minimum Distributions (RMDs) and other taxable income would be the same.

Of course, her Social Security income would decrease as she would keep the larger check and lose the smaller Social Security check (it matters not which spouse passes).

With the reduced Social Security income, her modified AGI would be $171,000. But her standard deduction would only be $14,350 instead of the joint deduction of $28,700. That leaves her paying income taxes on $156,650, which would be about $31,263.

That’s more than $6,500 higher than what they would have paid should he still be alive! But it gets worse.

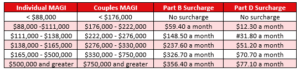

I’ve written about the IRMAA tables before, which determine if a couple or person would pay a surcharge on their Medicare Part B and D premiums or not.

Now, in reality, there is a two-year delay in assessing income for IRMAA purposes. For example, 2022 Medicare premiums are determined by income in 2020. But let’s leave that aside for now and look at the bigger picture.

As a couple, they each would pay $170.10 for Part B ($4,082.40 combined).

But as a single filer, her penalty is $374.20 per month ON TOP OF the $170.10 due to her income. That’s a total Part B premium of $544.30 per month ($6,531.60 per year). That’s a $2,500 penalty for being a widow(er)!

But there’s more! Her Part D (for prescription drugs) went up as well!

Her Part D premiums went up from $12.40/month EACH to her $71.30 per month. That’s over a $700/year increase as a widow.

On less income (one less Social Security check), she is paying $6500 more in income taxes, $2500 more for Part B, and $700 more for Part D. That’s about $9,700 increased costs… on LESS income!

OK, there’s the potential problem. What are my solutions?

Well, those that have done retirement income plans with me know that I am a big advocate of ROTH conversions using tax bracket management. What this couple should have done is do ROTH conversions all along – especially before RMDs must begin at age 72.

I also recommend to most folks that they contribute to a ROTH instead of a traditional (deductible) IRA.

There are no RMDs on ROTHs, and more importantly, income from ROTHS is NOT taxable. Nor does ROTH income figure into the IRMAA calculations to determine Medicare premiums. A ROTH would completely change her tax situation for the better.

Why doesn’t everyone contribute to a ROTH or convert their IRAs to ROTHs?

Because they don’t like paying taxes. But taxes are going to be due some time. There’s no escaping them. That’s the deal you signed up for with the IRS when you took the tax deductions for your IRA contributions.

I’d much rather pay taxes at known rates, brackets, and deductions today than at unknown rates, brackets, and deductions in the future. The taxes are owed to the IRS, and I’d rather pay them on my terms than leave it to theirs.

There is another solution, life insurance. All IRAs have relatively low contribution limits ($6,000 or $7,000 per year, depending on your age).

For ROTHs, if you make too much money, you must jump through hoops to get one (a backdoor ROTH).

In any case, for most folks, those figures won’t provide the level of retirement they are hoping for. You may not know that with life insurance, there are NO IRS contribution limits. You could put $100,000’s or more into a policy every year.

Anyway, getting back to our widow, a death benefit check will not change the taxation described above, but it will positively impact her ability to pay the increased taxes/premiums without affecting her lifestyle.

And sometimes, only when appropriate, rather than converting an IRA to a ROTH, I recommend taking funds from the IRA and using them (after paying taxes) to fund a large life policy. But that’s a story for another day.

I hope you learned something from this and all of my blog posts as well.

all the best… Mark