Any way you look at it, missing even just a few days in the market can adversely affect your retirement. In this blog post, we’ll look at this issue with three different charts.

But staying fully invested can be difficult when markets are plummeting. I get that. We all understand that over time the market does something like 10% average annual returns. But there’s something called the sequence of returns risk that can destroy a retirement income plan – especially when we have negative returns early in our retirement withdrawal phase.

So at the end of this post, I’ll show you how I keep many of my clients out of harm’s way with my withdrawal strategy.

Let’s look at our first graph provided by Dimensional Fund Advisors, formed by two Nobel prize winners. That firm manages a part of many of my client’s portfolios.

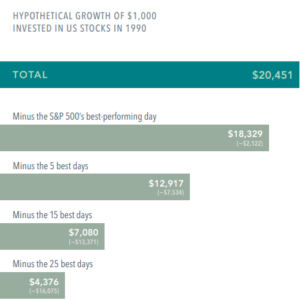

This image shows the impact of missing just a few of the market’s best days. And missing those days in the market due to market timing can be devastating, as this look at a $1,000 hypothetical investment in the S&P 500 Index in 1990 shows. Staying invested and focused on the long term helps ensure you can capture what the market has to offer.

Staying fully invested, a hypothetical $1,000 turns into $20,451 from 1990 through 2020 over those thirty years.

Miss the S&P 500’s FIVE best days, and the return dwindles to $12,917.

Missing just fifteen days cuts your growth down to $7,080.

Miss the 25 best days, which slashes the growth to $4,376. Only $4,376!

There’s no proven way to time the market—targeting the best days or moving to the sidelines to avoid the worst — so history argues for staying put through good times and bad.

Missing only a few days of the strongest returns can drastically impact overall performance over a thirty-year period.

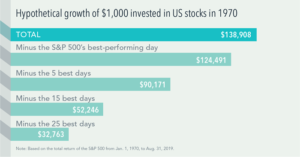

How about not staying invested over a 50-year period?

Missing just the 25 best days in the S&P 500 over five decades would have cost an investor more than $100,000 of gains for every $1,000 invested back in January 1970!

Now, let’s look at how missing the TEN best days in the market changes your return for each decade. You can see the huge difference in 10-year returns in each decade. By staying fully invested, the positive impact is stark indeed. In some decades, the market timers for just 10 days would have missed half of the gains the market would have given them.

There is no decade where timing the market would have been a wise choice. Wouldn’t you agree?

So, how do we stay fully invested when taking withdrawals or even RMDs (Required Minimum Distributions) the world seems to be falling apart?

One way is the BUFFER strategy that I describe in my book, “BUFFER Annuities: No Fee Bond Alternatives for a Smarter Withdrawal Strategy” (available in paperback or KINDLE on amazon.com). BUFFER annuities can earn respectable average annual returns of 5%-8% or more with ZERO stock market risk. Your worst return is 0% rather than a loss.

Bonds can’t promise a worst-case of 0% return. As of last Friday, the bond index is down close to -16% so far in 2022.

Here’s the 30-second version. The market goes up three out of four years on average. So when the market was up the previous year, I take the withdrawal/RMD that I need from the gains the market gave me -which is most years.

When the previous year had a substantial loss in the market, I take the withdrawal/RMD from my BUFFER annuity – which suffered no loss. Not touching my market-based portfolio, I don’t sell when the market is down. I let the market recover as it always has. I stay fully invested, so I don’t miss out on much of the returns the market has historically given investors.

If the market is down two years in a row, we take our withdrawal/RMD from the BUFFER again. No big deal – it had no losses. Let our other portfolio rebound. It will in time, and then we take distributions from the market, taking the gains the market gave us.

Nobody can time the market. You’ve got to be right twice — on the way out… and on the way back in. The three charts above should prove that beyond a shadow of a doubt.

all the best… Mark