On Nov 19, 2019, Bank of America declared ‘the end of the 60-40 standard portfolio” (60% stocks and 40% fixed income/bonds). In a research note published by Bank of America Securities titled “The End of 60/40 portfolio” strategists Derek Harris and Jared Woodard argue that “there are good reasons to reconsider the role of bonds in your portfolio”.

On July 2nd, JP Morgan joined the list of Wall Street banks calling for the demise of 60/40 portfolio despite its success this year. Their market strategists say a “traditional 60/40 portfolio will deliver annual returns of 3.5% over the next decade, compared with up to 10% over the past few decades”.

Most American’s retirement cannot even last 20 years with average returns of just 3.5%! If that is the best they can do – folks need to fire them! My bond alternatives alone should do 30% better than that – with no fees nor market risk.

I’ve mentioned this many times before, that Dr. Wade Pfau, CFA told Forbes magazine in 2015 that “bonds don’t belong in a retirement portfolio”. And that was when interest rates were 2-3 times higher than today! That was five years before Wall Street! He still believes and teaches that today.

The biggest reason why Wall Street is saying this now is because bond yields are so low and unlikely to get measurably higher any time soon. What’s Wall Street’s answer to this dilemma? Buy more stocks. Take more risk.

Most of my clients and a large number of pre-retirees and retirees do not WANT to take more risk. They want more predictability and consistency and less financial stress and worry.

They just went through the scare of the fastest/biggest market drop in decades (albeit with the quickest rebound thanks to the Federal Reserve throwing $4 TRILLION to ease the markets and CONGRESS tossing in another $3 TRILLION in stimulus packages so far. What is that going to do to our taxes? That’s a future blog post and one I very much look forward to writing.

But in this BLOG POST, I am going to state my case against the traditional 60/40 portfolio and bonds playing anything more than a minor role in your portfolio and more importantly, explain a much better strategy to help control and actually reduce sequence of returns risk while taking distributions and/or Required Minimum Distributions (RMDs) from your portfolio – while better protecting and even improving your total returns over time. That’s a mouthful!

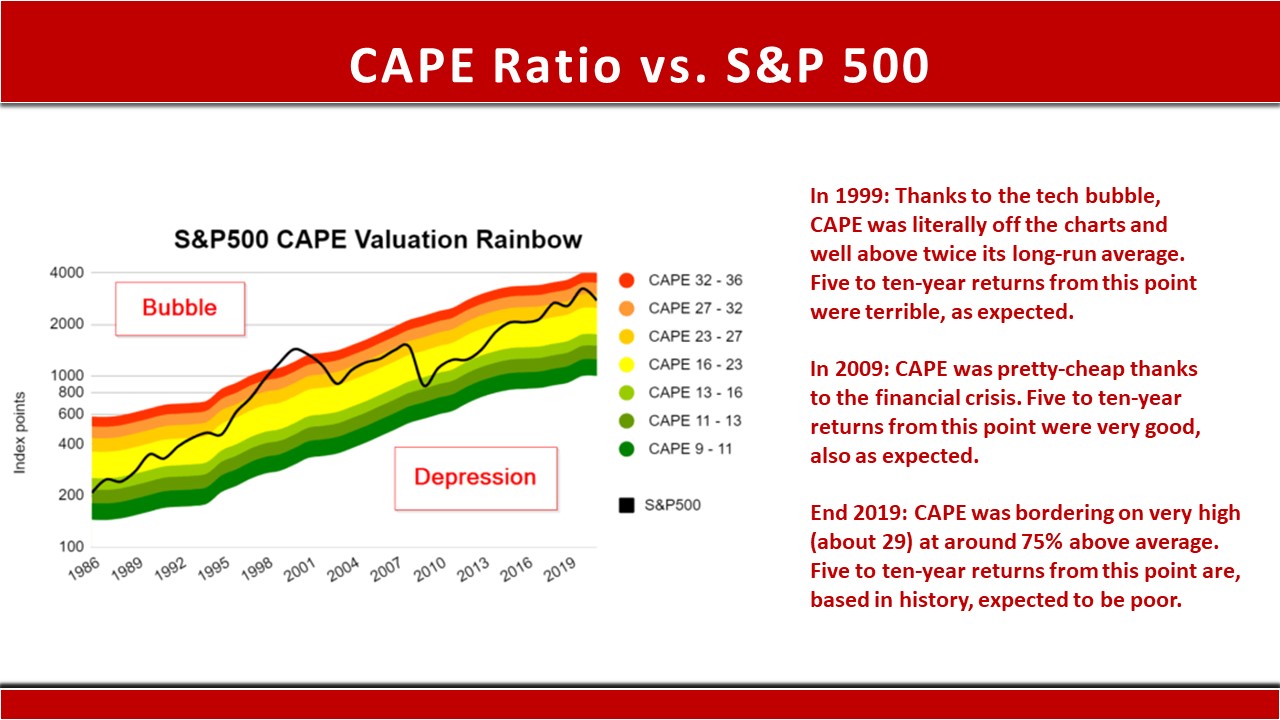

No matter what you think about the prospects for the stock market over the next 6-12 months, Noble-prize winner Robert Shiller had thought (even before COVID-19) that the stock market was overvalued according to his CAPE Ratio.

The CAPE ratio is the Cyclically Adjusted Price to Earnings ratio. Personally, I think the market had been overvalued during most of 2019 when the market went up 30% but real corporate earnings/cash flow/dividend increases didn’t merit those high returns. In my opinion, the rise was all about corporate stock buy-backs, corporate tax cuts, and the public’s FOMO (Fear of Missing Out).

You can see the BLACK line is the S&P 500 and the REDDER the bands are, the less likely returns in the stock market will be even average (let alone double-digit). The more the S&P is in the green/yellow bands, the better the expected returns are over the next 5-10 years. The notes on the right of the bands explain it pretty well.

As of June 26, the CAPE ratio was 28.1, which is 43% above the modern-era market average of 19.6, putting the current P/E over 1 standard deviation above the average. This indicates that the market is Overvalued.

That doesn’t mean it won’t keep going up for a while though.

By the way, the Buffett Indicator Model (named after Warren Buffett, who claims this as his favorite macroeconomic indicator) is the ratio of total US stock market valuation to GDP. This is currently 61% higher than its historical average, indicating the market is currently Strongly Overvalued. Of course, he is not panicking… but he isn’t taking withdrawals from an IRA to meet his monthly expenses either.

The stock market is going to do what it is going to do. It is often irrational and way overshoots to the upside as well as overshoots on the downside – mostly propelled by fear and greed.

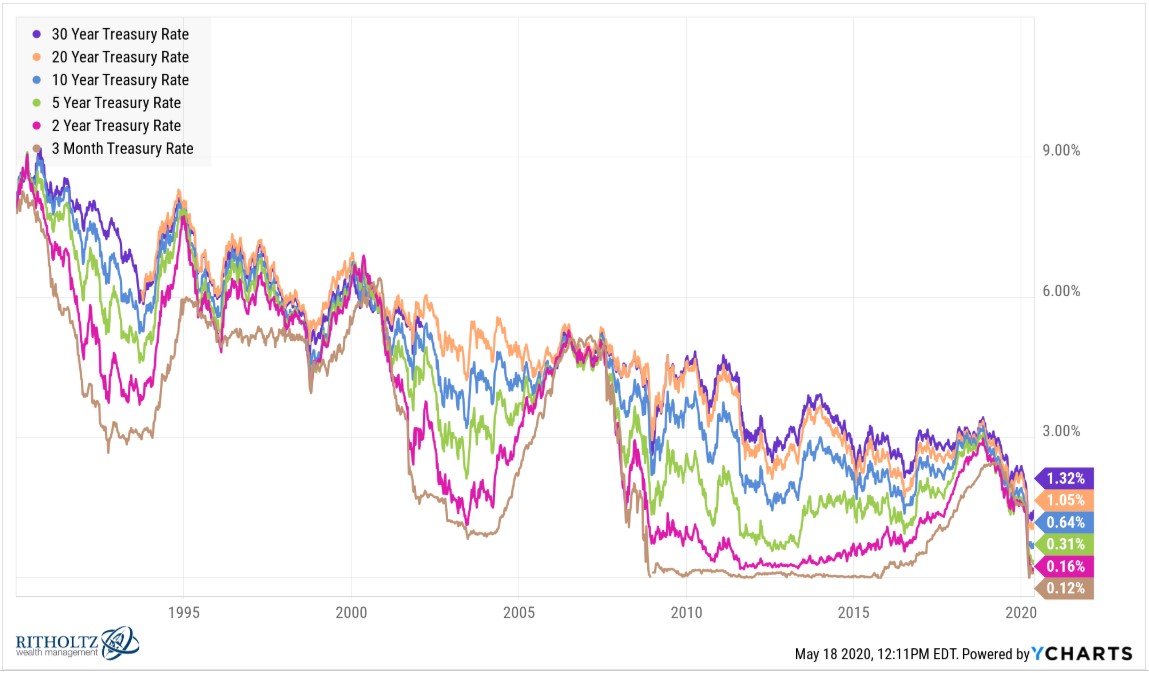

Let’s continue with the case against bonds in the traditional 60/40 portfolio. I mostly agree with Dr. Pfau – that with the current low-interest rates of virtually all bonds and the credit risks of all non-US Treasuries plus interest rate risk for all bonds – bonds should play no more than a minor role in a retirement portfolio. Oh yeah – bonds have inflation risk too. We need to find more attractive bond alternatives.

Let’s dive into this a bit more but this next chart pretty much says it all.

At the moment, the 10-year U.S. Treasury note yield, stands at 0.68%, while the 30-year US Treasury yields about 1.4%. Would you loan your money to anyone at 1.4% for a 30-year period? Heck no. The U.S. Aggregate Bond Index (AGG), comprised of government debt, mortgage-backed debt, and highly rated corporate bonds, offers a yield of about 2.45%. That is only slightly better than inflation (before taxes).

Keep in mind that bond coupon rates are fixed. If you buy a $100,000 of an AA-rated 20-year corporate bond today with a fixed coupon rate of 2.5%, you’ll get paid $2,500 interest every year for 20 years and then (hopefully – if you didn’t buy a bond from a future JC Penny, Hertz, etc.) you’ll get your $100,000 back. You have credit risk too.

What investor can live on a fixed 2.5% income? Inflation is not fixed – it compounds over time! Even at 2% inflation in just 5 years that $2,500 of fixed income would only buy $2,260 worth of stuff in today’s dollars. Only $2,043 worth of stuff in 10 years’ time. Inflation is a fixed-income investor’s worst enemy. That’s a loser’s game long-term.

But it gets worse. Bond prices move in the opposite direction of yields. At these historic low-interest rates, should interest rates return to more normal levels, the prices of bond in your portfolio will nosedive.

Wall Street has been telling older investors for decades: have 30%-60% of your portfolio in fixed income. My answer to this for the last dozen years when the problems with bonds became more apparent and worrisome to me was no-fee Fixed Indexed Annuities (FIAs) with guaranteed growing joint lifetime income. They are not subject to market risk, interest rate risk, credit risk, or the ones that I use, inflation risk either. And with no stock market risk – they have no Sequence of Returns risk either. Over the long haul, my favorite FIAs will beat a bond portfolio hands down every time. But they only help reduce sequence of returns risk – not solve it.

Again, this article is not about a product but about a real strategy to solve real financial and retirement income problems as you’ll see in a moment. The problem I’m solving today is sequence of returns risk.

As you know, I’m an overall strategy and planning guy… rather than a product guy. Products are just financial tools – like golf clubs. They just get you around the golf course. So, this article is about strategy – not products.

So how can we use bond alternatives to get better performance from our portfolio while reducing sequence of returns risk with taking distributions or RMDs? That’s where the “Buffer” strategy comes in.

To be fair, I adopted this genesis of this strategy from Dr. Wade Pfau. But his solution for taking portfolio distributions after a big down year in the market was to access funds from a reverse mortgage and let your portfolio rebound (as the markets always have). Reverse mortgages are fine and that may be a good solution to the problem, but I think mine is better – and doesn’t cost you set-up fees nor do you accrue mortgage interest on any withdrawals. He calls it a “Buffer Asset Concept”. And that describes it pretty well.

He uses a reverse mortgage as a “Buffer” when the markets go down. Of course, rather than taking funds from a reverse mortgage, you could keep 2-3 years of potential distributions to do the same thing with cash at the bank. But interest rates at banks are awfully low. CDs and bank saving accounts hate inflation. You could use a cash-value life insurance policy too that have no market risk. But I prefer to use them for scheduled annual tax-free distributions.

OK, let’s discuss the “Buffer” strategy more deeply and how this can completely change the future of retirement income planning – and more importantly – YOUR RETIREMENT!

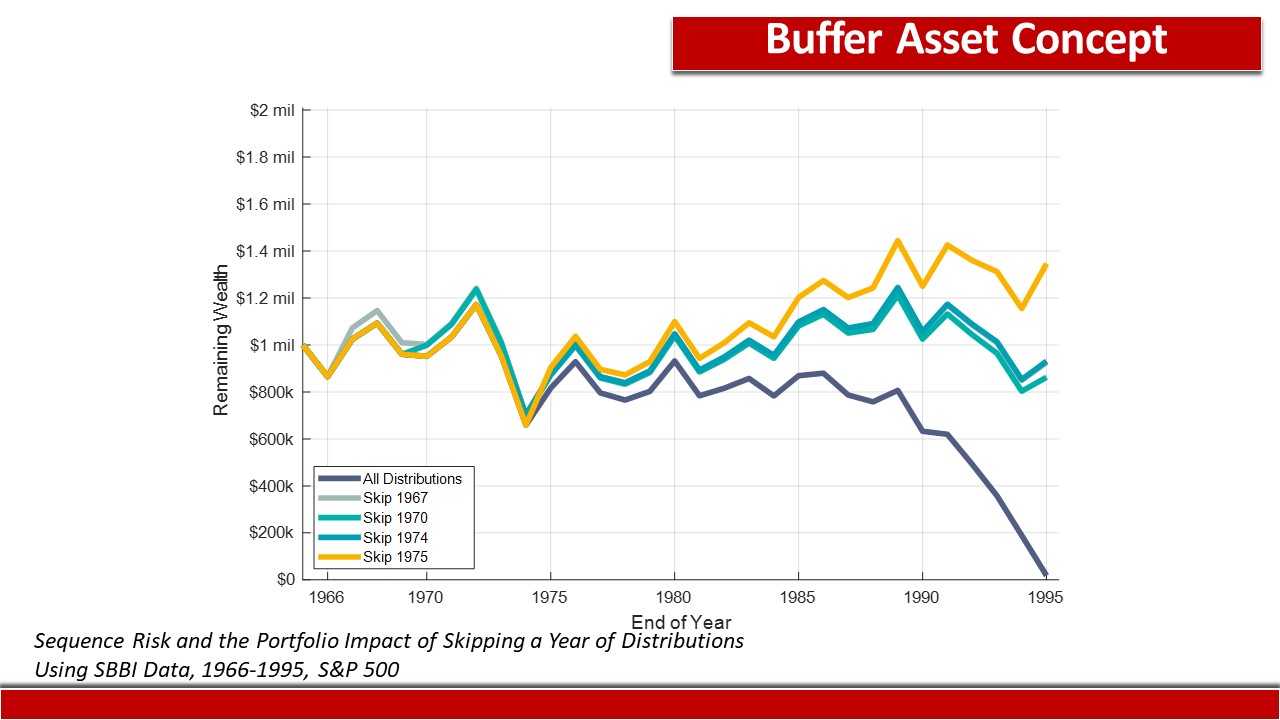

Sequence of returns risk occurs when you are taking money out of your portfolio when the stock markets have had a bad year. So, you are selling stocks after losses to fund your retirement income needs or RMDs. But since you spent those withdrawn dollars, the stocks are not in your account to grow back with the eventual market rebound.

But what if you didn’t have to sell stocks after a down year to pay for your retirement expenses/RMDs. What if you could take those funds from an account that did not suffer any losses – like bonds were supposed to do. You could take it from your savings account at the bank. Pfau likes to use reverse mortgages (but not everyone has home equity or desires to use it). I like to use one of my bond alternatives.

So in Dr. Pfau’s research, he goes back to 1966-1995 and Bill Bengen’s 1996 “4% rule” (of thumb). Where every year you take 4% out of your initial portfolio’s value at the beginning of your retirement and adjust the withdrawals by inflation every year. In the past (when bond rates were much higher than today) that would allow your money to last for a 30-year period of time with a 90% success rate (that you don’t outlive your money).

In 2013, when bond interest rates were much higher than today, Morningstar suggested the safe withdrawal rate should be 2.8% and in the same year, the Wall Street Journal wrote about a 2% safe initial withdrawal rate for 30-year retirements.

Dr. Pfau now says the safe withdrawal rate is 2.3% adjusted for inflation – mostly due to low bond interest rates.

In any case, it’s sequence of returns risk that can spoil the party – especially having negative returns in the first 5-10 years of your retirement. So this is where the buffer concept can help make your retirement savings last and perhaps even be much larger at the end of 30+ years.

In this first graph, Dr. Pfau shows the impact of taking regular 4% distributions from your portfolio every year (dark blue line) and how just skipping ONE year’s distributions (either 1967, 1970, 1974 or 1975) after a bad year in the market can dramatically improve your lifetime retirement results (the other lines). Each different-colored line shows skipping distributions just that one year (following a bad market). Not selling stocks when they are down to pay for the next year’s expenses. Giving your portfolio time to rebound. That’s why he calls it a buffer asset concept.

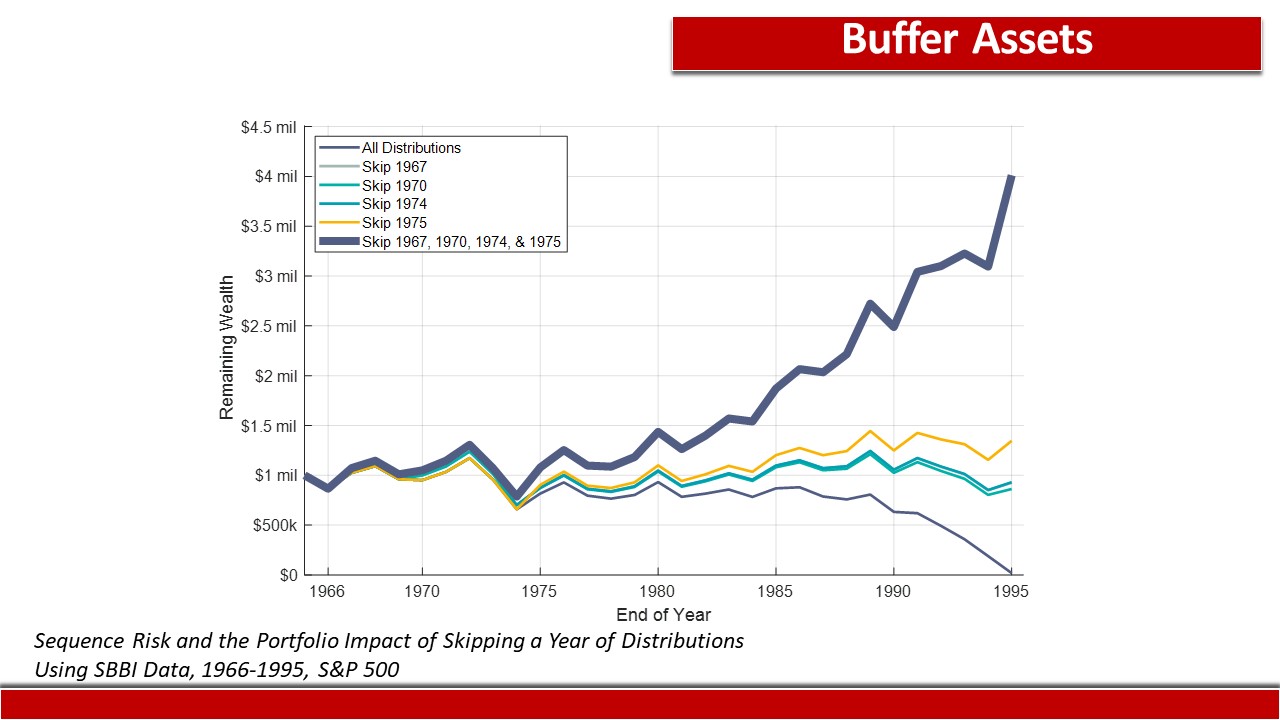

The next chart shows skipping each one bad year again…. AND believe it or not, it shows the positive effect of skipping ALL FOUR of those bad years by using the buffer concept. The dark blue line below skips ALL FOUR of those bad years – by taking distributions from another source (and not from the portfolio with a lower value due to bad market returns).

Look at the remaining wealth. And for my clients who aren’t very interested in leaving a legacy to children, grandkids or charity – imagine spending and enjoying those extra dollars – without market stress!

Of course, every 30-year period will not look exactly like this one. But it’s a gamechanger. Can you see the value of using some sort of buffer strategy?

As I said, it used to be the job that bonds held. But for the foreseeable future, I think depending on bonds is a mistake. The short to medium prospects for bonds is not appealing. A reverse mortgage can work. So can a couple of years of potential distributions/RMDs kept at the bank or cash-value life insurance. But my strategy is much more powerful, offers higher potential returns and has less risk.

So let’s put the buffer strategy all together. Let’s say you have a 60% stock/40% fixed income portfolio. You now understand a better way to minimize or take sequence of return risk off the table by using my buffer strategy.

You take a portion of your portfolio that is currently invested in bonds/fixed income (some of which is likely invested in 1 to 10-yr US Treasury’s paying way under 1%) and diversify into one or two of my favorite bond alternatives. That way you can let your stocks run when the market is going well. Our investment management firm uses guardrails to help protect our portfolios from falling more than a pre-determined percentage (going to cash, etc. when the inevitable 10%, 15% or 20% market corrections occur).

Whatever is left in your investment account you can keep in a 60/40 portfolio if that’s where you started. Or you could get more aggressive for better longer-term returns with an 80/20 – especially if you have years until retirement.

For folks with a 40% stock/60% bond portfolio currently, you might want to get more aggressive and go into a 60/40 portfolio using this strategy after shifting some funds to the bond alternative. In any case, you’ll get likely get better total returns, experience much less volatility, have less overall risk, and lower your fees.

Once I get more clarity with the “new” coronavirus-economy, we’ll (Norma) likely go back to our normal 80/20 with her IRA money with the remaining funds after we shift some funds to the bond alternatives ourselves. But for now, I’m happy with a 20/80 there (after our firm’s COVID guardrails were put in place with the acct balance).

I’d like to get back in when the CAPE ratio, Warren Buffett Model indicator and the market indicators our firm uses are pointing to better returns ahead. But there will never likely be a perfect sign to get more fully invested again – and you can’t stay out of the markets forever. At least we’re protected by all of our life insurance policies, FIAs with guaranteed lifetime income and our new bond alternatives (we’re using 2 of them for diversification)

Anyway, the strategy boils down to: after good market years, take the full distribution/RMD out of your stock account (selling “high” rather than “low”) and let your bond alternative(s) continue to safely build.

Then, when markets have had a bad year, instead of taking your distribution/RMD from the investment portfolio, you take the full distribution needed from the bond alternative which did not/cannot go down in value. And you let your other investment account recover with the market (as markets always have). That way your investment portfolio can look more like Dr. Pfau’s buffer concept charts above. Simply rinse and repeat for a stress-free retirement.

If you have any questions about this strategy or would like to discuss it further with me, please reach out by email or phone.

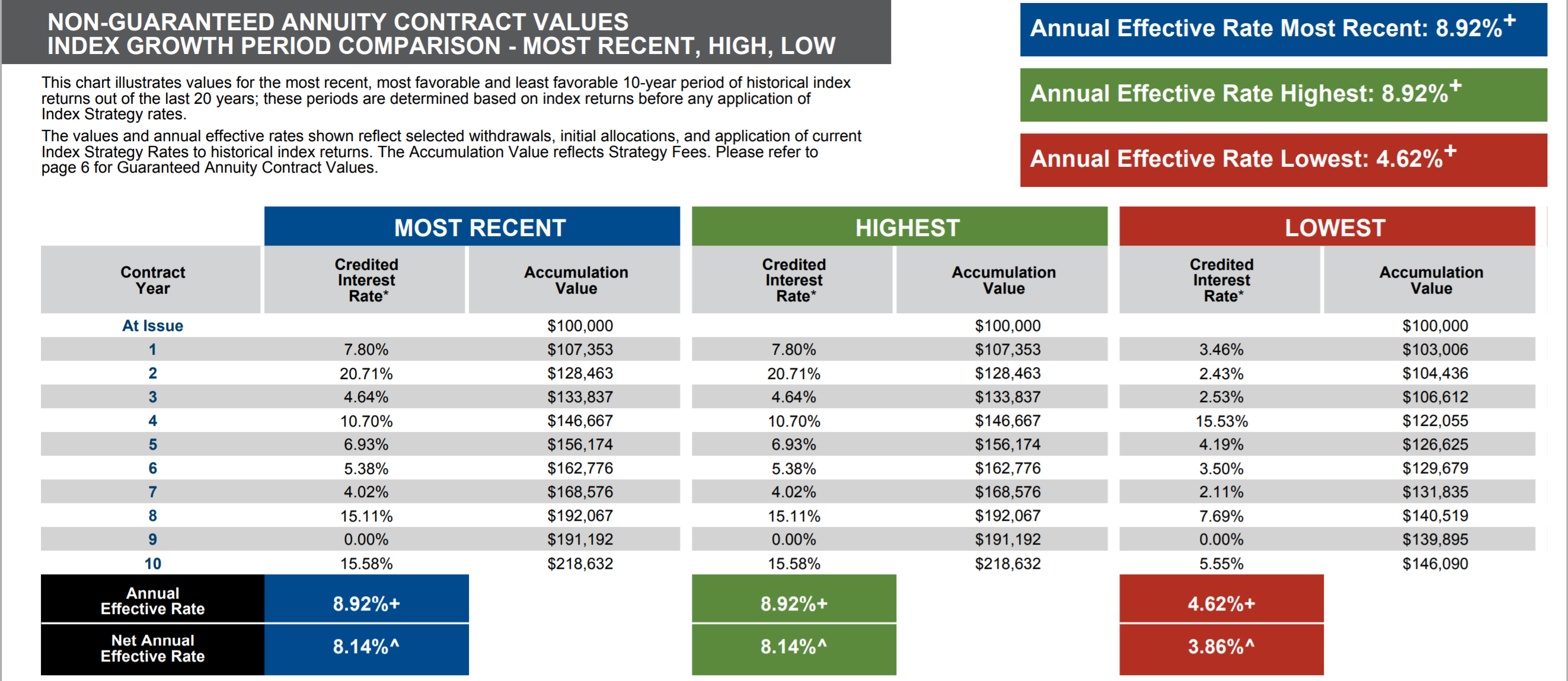

By the way, the image below is from a similar bond fund/CD alternative (different from the one I highlighted in my last BLOG POST) which also has no-fees If you don’t want more earnings potential, no stock or bond market risk, no credit or interest rate risk, tax-deferral (no 1099’s unless you make a withdrawal of earnings), short-term and flexible with some exciting potential returns (as compared to bonds/CDs). Oh yeah… and NO sequence of return risk either. It “pairs” wonderfully well with its “cousins” – the guaranteed lifetime income annuities (FIAs) too.

If you missed it or want to read it again you can CLICK HERE.

The chart below gives you an idea of potential returns (using a 50% mix of optional fees totaling .75%) of this different annuity with different index strategies from Fidelity and potential returns without market risk. I like to diversity using different products with different indexes. Every year one will outperform the other – but we’ll never know which it will be. Again, not bad returns for a bond/CD alternative.

Although many will think that those look more like stock market returns (and they are tied to the stock market without being invested directly in the markets), I think adding this strategy could enhance overall returns while reducing sequence of returns risk.

We’re not trying to compete with stock – just replacing a portion of our bond portfolio with something that’s can’t lose value and structure our retirement distributions/RMDs accordingly.

all the best… Mark