In fact, this can be anyone’s Hedge Fund alternative since it has few financial qualifications and a $10,000 minimum investment ($25K in TEXAS). The maximum investment is $1 million. Truth be told… it’s not a hedge fund at all.

It’s a special type of annuity. Issued by a few highly-rated insurance companies.

But hedge funds are “sexier” and annuities are boring – but not these!

In this, what I call a “fixed income (bond) hedge fund alternative”, your worst return in any year is guaranteed to be zero. Not much less than CDs today!

There are NO FEES at all and the potential to earn 8%-12%+ in good years with no market risk (unless you opt to pay a small fee for even higher potential returns) and no caps on earnings whatsoever.

You’ll see sample returns over the past 10-20 years using rules-based algorithm indexes (one is from IBM’s Watson supercomputer) below. It’s just one of the 3 indexes I use (there are 5 indexes to choose from including the S&P 500) each year.

I’m using this for a bond fund/CD alternative since bonds/CDs are paying historically low rates and aren’t likely to hit the above-cited potential returns any time soon. But folks who are wary of the stock market volatility are interested too.

In times of market volatility, hedge funds attract billions of dollars – despite the fact that many of them totally underperform the S&P 500 over 3, 5, or 10 years. Hedge funds managers generally get 2% annual fees plus 20% of your profits (you take ALL the risk since they do not share in any of your losses!)

Of course, there are some superstar hedge funds (usually with a 250K+ min investment) – but the trouble is, you don’t know which ones (out of literally 1,000’s) the top 20 hedge funds will eventually be. High costs, long-term commitments, substantial risks, and no guarantees whatsoever. Not for me!

Again, in this fixed income hedge fund alternative, your worst return is zero. There are no fees (unless you opt for some), only a 7-year holding period and you can get 10% of your initial investment out every year without any penalty. For the right people/situation, the funds can be from an IRA, old 401K… or non-IRA type accts (non-qualified brokerage accts, CD replacements, fixed annuity alternatives, etc.). This can fit well many retirement plans.

Dr. Wade Pfau, CFA told Forbes magazine in 2015 that “bonds don’t belong in a retirement portfolio”. And that was when interest rates were 2-3 times higher than today! He still believes and teaches that today.

I now mostly agree with him – that with the current low-interest rates of virtually all bonds and the credit risks of non-US Treasuries plus interest rate risk for all bonds – bonds should play no more than a minor role in a retirement portfolio. We need to find more attractive alternatives.

Rather than competing with risky stocks equity mutual funds and ETFs, I position this product as a bond alternative. In a near-future BLOG POST, I’ll be writing about WHY and how I position this as a bond alternative in my retirement plans and for my investment clients that are open to discuss this.

As you know, I’m much more of an overall strategy and planning guy… rather than a product guy. Products are just financial tools – like golf clubs. They just get you around the golf course. But this can be an opportunity or a solution for a number of problems with no market risk, tax-deferral (no 1099’s unless you make a withdrawal of earnings), short-term and flexible with some exciting potential returns. Oh yeah… and NO sequence of return risk either.

Your investment is backed by an A rated (AM BEST) public insurance company. And again, your money is never invested in the markets – your investment is never subject to market risk. Your actual returns are simply linked to the returns of the indexes used. The insurer uses options on 1 and 2-year indexes to get returns. There are 5 indexes, I typically would use 3 of them with all of them diversified in the 1-year and in the 2-year indexes.

This is product is strictly designed for tax-deferred accumulation and growth without market risk. There are no attractive guaranteed lifetime income options nor any LTC benefit doublers. It can be a “set-and-forget” or actively managed once a year (which is what I suggest).

Let’s say Joe never wants to pay any fees and is just looking to have a slow and steady growth. Here are returns based on my suggested index allocation (for diversification) with NO FEES – zero costs. In this allocation (immediately below) I diversified with the 3 indexes — 50% in the 1-yr allocation and the rest in the 2-yr. That is why the biggest returns tend to be in the even years. The 2-year always has higher potential returns – BUT we have to wait 2 years to see what we earned and get the interest credited to our acct. BUT I like to get at least some return every year which is why I usually put at least 25%-50% of the funds in the 1-yr allocation. But you can put some, all or nothing in the 1-year allocation.

You get to decide exactly how you want to allocate the funds every year (I’m always happy to help with recommendations). I want your account to safely grow! See what’s in it for me at the end of this post. You can decide what, if any fees (to buy more options), you’re willing to pay each year for a potential higher return.

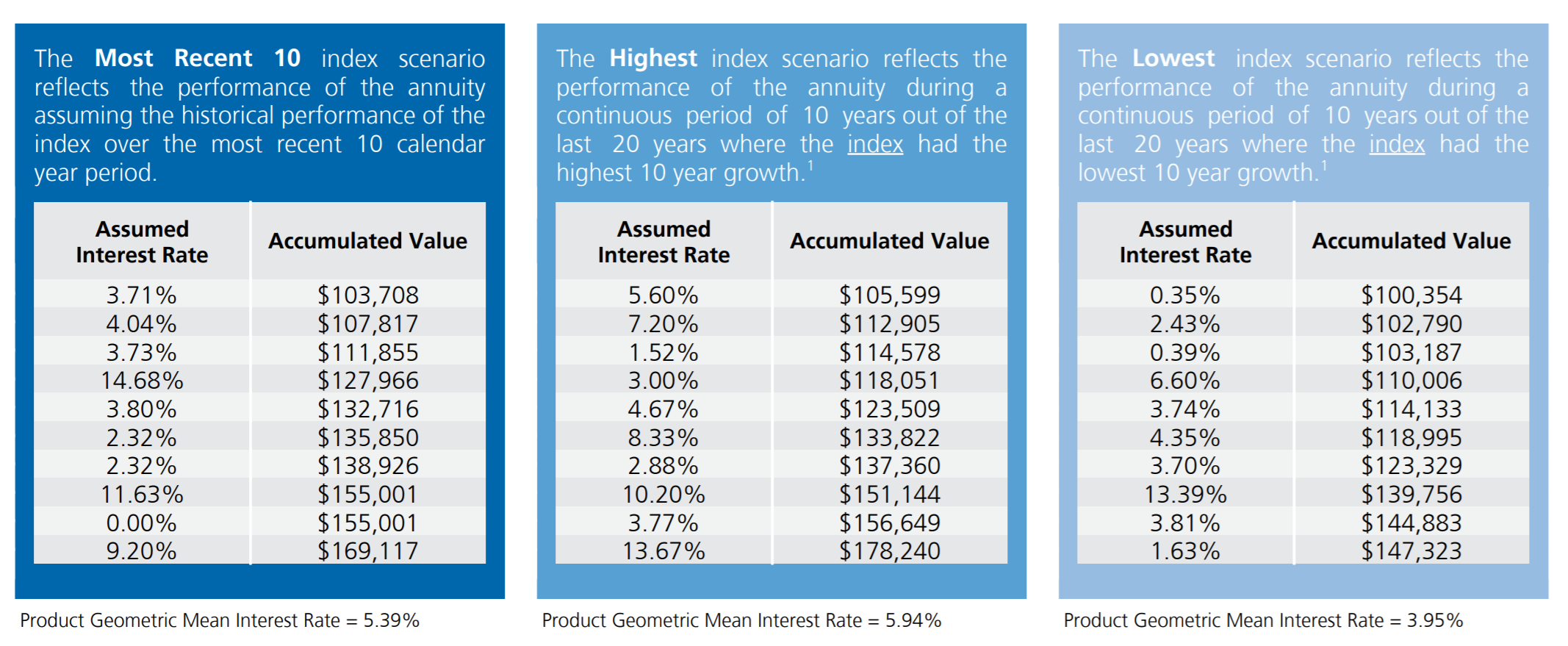

The left box is the most recent 10 calendar years, the middle box is the best 10-year period out of the last 20 years (some 2,000 tested periods) and the right box is the worst 10-year period out of the last 20 years. But there are no fees in the 1st row of boxes below.

The next 10 years will not look the same as the last 10 years. I think they won’t be as good… but they could be better.

When including this CONSERVATIVE allocation inside of one of my retirement income plans, I’m using very conservative average annual gains of only 4% – which is about what the worst 10-year period was and well below the other two boxes. That is higher future returns than what most believe the Bond Index will provide with less risk. If actual returns are better than that – the income plan becomes better as well. Remember that since 50% of the funds are in the 2-yr bucket, they never get any interest credited until the end of the 2nd year.

Now these indexes did NOT exist 20 years ago but back-tested using the same rules-based algorithms for determining the investments within each index. Of course, future returns are not guaranteed (other than a 0% return when markets go down) and will likely be very different than shown. Bonds, bond mutual funds, and bond ETTs have NO guarantees at all, more risk, and higher expenses. And you will notice there are pretty similar returns across the board (both good and bad) over the 10-year period in the most recent, highest and lowest charts right below.

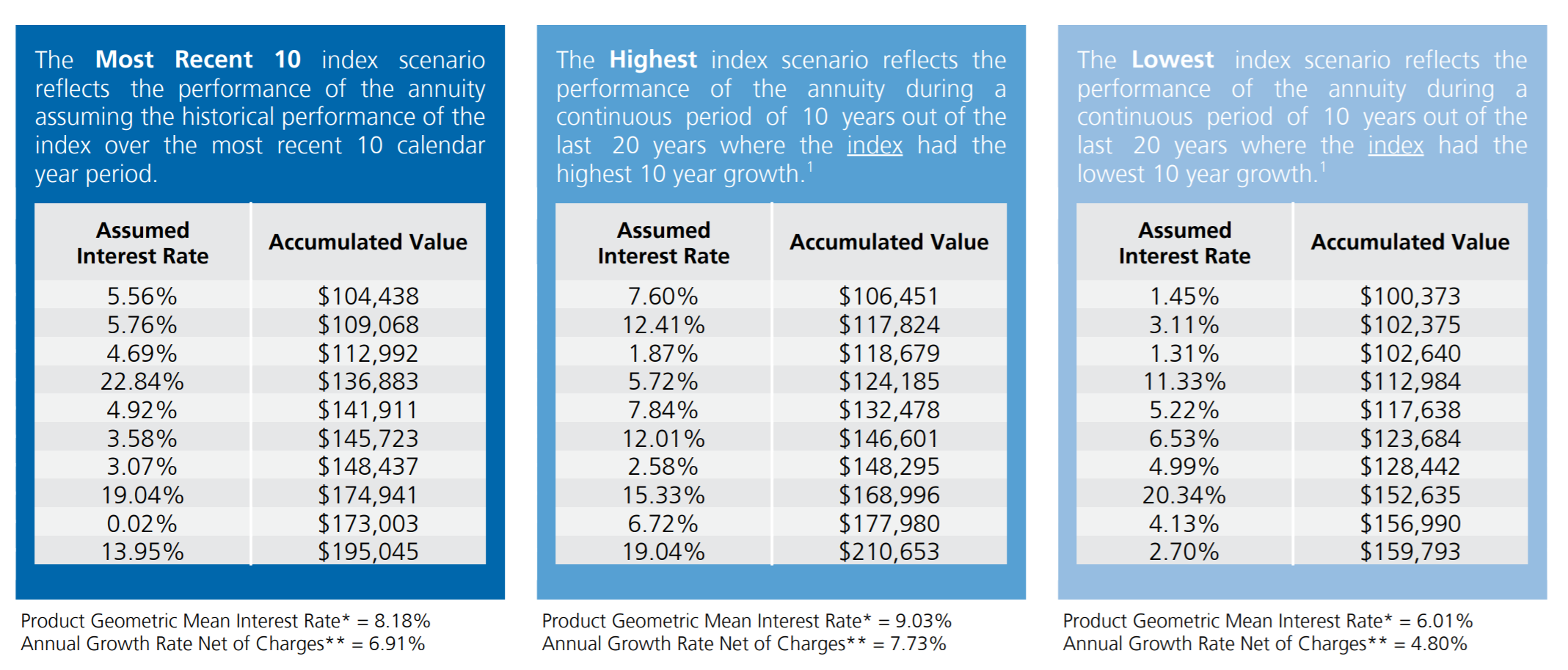

Now Mary is OK with paying some fees since that’s what she pays her advisor to manage money with her bond funds. In the next set of images below, are returns based on my suggested index allocation (diversification) with half of the indexes having NO FEES and the other half (optional) costing 1.75% annually – for an overall net fee cost of 0.875%. The optional fees allow for higher potential returns – while your worst return is 0% in any year – except for any optional fee charged to purchase more upside potential (more options).

Again, I split 50/50 split between the 1 and 2-year allocations. Recall there are higher potential returns in the 2-year allocation — which is why you will notice the bigger returns in the even years. Earnings would be smoother and likely lower if 100% of the funds were in the 1-yr buckets.

There is no interest credited to any allocation in the 2-yr indexes until the end of the 2nd year. BUT I like to get at least some return every year which is why I usually put at least 25%-50% of the funds in the 1-yr allocation. You get to decide however you want to allocate the funds every single year.

The left box is the most recent 10 calendar years, the middle box is the best 10-year period out of the last 20 years (some 2,000 tested periods) and the right box is the worst 10-year period out of the last 20 years. The returns shown below are NET of the 0.875% annual fees (optional) – returns the investor gets to keep.

The next 10 years will not look the same as the last 10 years. I think they won’t be as good… but they could be better.

When including this MODERATE allocation inside of one of my retirement income plans, I’m using very conservative average annual gains of only 4.5% – which is about 15% lower than what the worst 10-year period was and well below the other two boxes. My clients know I try and be conservative with any projections. That is higher returns than what most believe the Bond Index will provide with much less risk… and more upside. If actual returns are better than that – the retirement income plan becomes even better as well. I like happy client calls!

Here, you’ll notice that all three boxes have at least 6 years (out of 10) with 4% or greater return (more than a diversified bond strategy is paying), at least 2 years of double-digit gains and average annual returns higher than 4.8% – even after the 0.875% optional annual fee. Keep in mind that since 50% of the funds are in the 2-yr bucket, they never get any interest credited until the end of the 2nd year. And again, no sequence of return risk.

Now, these indexes did NOT exist 20 years ago but back-tested using the same rules-based algorithms for determining the investments within each index. Of course, future returns are not guaranteed (other than a 0% return when markets go down) and will likely be very different than shown.

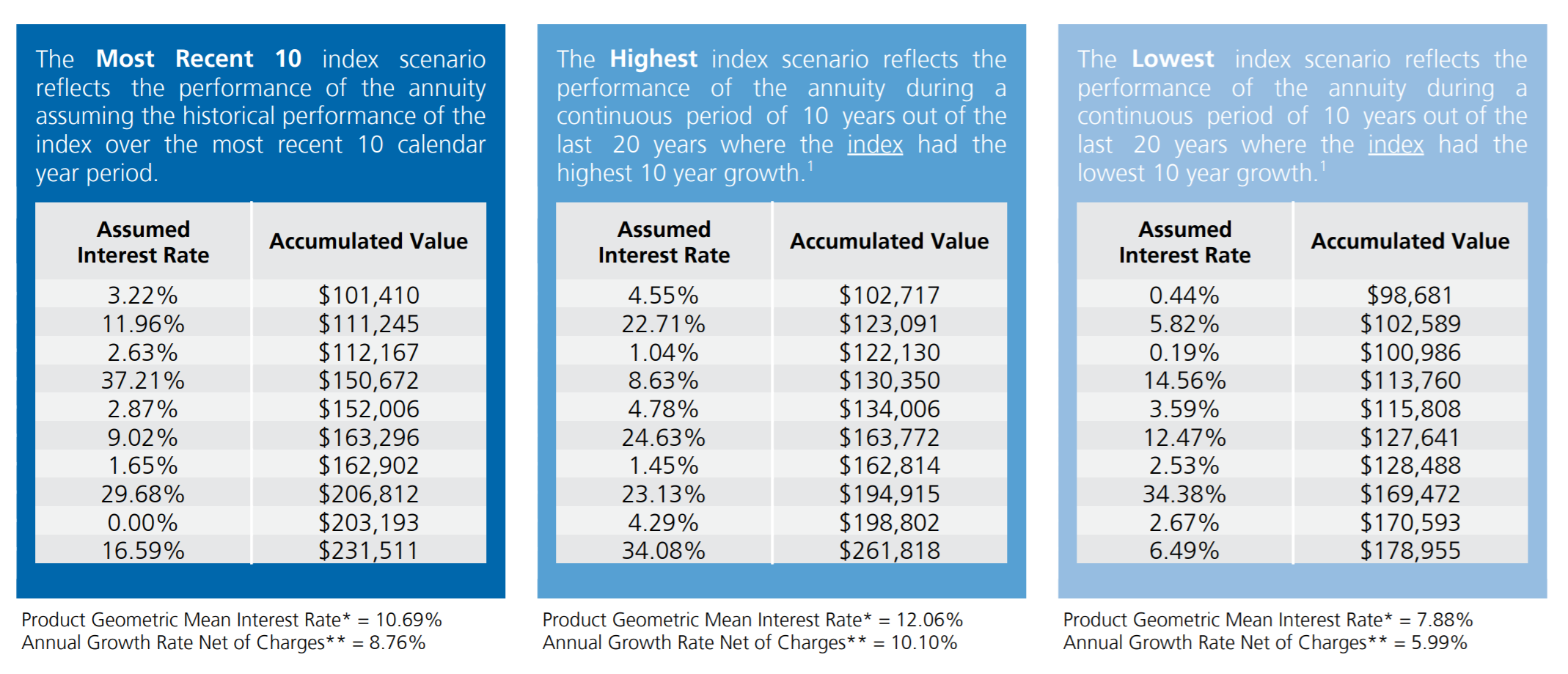

And finally, Steve has no issue with paying fees (to buy more options) for the potential for much greater returns. Here are returns based on my suggested index allocation (diversification) with ALL of the indexes having (optional) fees costing 1.75% annually. The optional fees allow for higher potential returns – while your worst return is 0% in any year – except for any optional fee to purchase more upside potential. Again split 50/50 between the 1 and 2-year allocations. You get to decide however you want to allocate the funds every year (I’m always happy and dedicated to helping with recommendations).

The next 10 years will not look the same as the last 10 years. I think they won’t be as good… but they could be better.

The left box is the most recent 10 calendar years, the middle box is the best 10-year period out of the last 20 years (some 2,000 tested periods) and the right box is the worst 10-year period out of the last 20 years. The returns shown below are NET of the 1.75% annual fees (optional) – returns the investor gets to keep. Again, there is 50% in the 2-yr allocation which is why the biggest returns tend to be in the even years and less in the odd years.

When including this more AGGRESSIVE allocation inside of one of my retirement income plans, I’m using very conservative average annual gains of only 5.5% – which is about 15% less than the worst 10-year period was and well below the other two boxes. That is much higher returns than what most believe the Bond Index will provide and closer to equity-type returns with much less risk. It certainly nearly triples the actual total return of the S&P 500 from 2000-2011 (including dividends). Anyway, if returns are better than that – the retirement income plan becomes better as well.

Here, you’ll notice that all three boxes have at least 5 years (out of 10) with 5% or greater return (more than a diversified bond strategy is paying) and at least 3 years of double-digit returns, and average annual returns higher than 5.99% – even after the 1.75% optional fee on every index. And again, since 50% of the funds are in the 2-yr bucket, they never get any interest credited until the end of the 2nd year.

Now, these indexes did NOT exist 20 years ago but back-tested using the same rules-based algorithms for determining the investments. Of course, future returns are not guaranteed (other than a 0% return when markets go down) and will likely be very different than shown.

I forgot to mention one HUGE fact in regards to the optional fee of 1.75% should you ever decide to take advantage of gaining more upside. If you use it and at the end of your 7 years, you paid more in fees than you got in gains, they would bring you back to even (as if you never paid the fees at all).

Let me explain it this way. Say you invest $100,000. If you paid 1.75% in fees for 100% of your index allocation every year (AGGRESSIVE allocation)… and each and every one of the indexes went down every single year (IBM’s Watson supercomputer picked the worst 250 stocks for 7 years in a row), at the end of the 7 years you could actually walk away with your full $100,000 back. In other words, they would refund all fees paid to get you back to where you started. Not likely to ever be needed or used – but it is guaranteed. I think that is very fair, don’t you?

One client told me it’s like gambling with no risk of loss. Try to get that guarantee in Las Vegas!

There are some other cool optional features, but I think you’ve hung in there reading this Blog Post for long enough! (Well hold on there is just another 25 seconds or so to read)

Of course, this is not for everyone or every situation for sure. No financial strategy or product is or ever will be. But I believe that it is certainly worth exploring for at least some of the bond portion of your portfolio given the current state of interest rates and the foreseeable future (or a CD alternative). And I certainly would never recommend it to you should it not perfectly align with your own goals and personal circumstances. I’m a fiduciary and always have to and do put my clients’ best interests first.

Full disclosure: How do I get paid?

The insurer pays me 1% directly on your account balance annually for as long as you keep the money in the account. My 1% fee does NOT come out of your account balance. It does NOT reduce your potential returns. There are no sales loads (and no fees unless you opt to buy more options for potentially higher returns). It is very much in our mutual interest to have your account grow (with or without the optional fees). I think you will want to keep going beyond the 7-year holding period and it’s my job to make you very satisfied (and you can always take 10% out each year without any penalty). But if there’s something better that comes along in the future, we can always move it to something that better suits any new goals or changing circumstances.

If you have an interest in looking at this potential option, please contact me and we’ll take a closer look.

all the best… Mark