If you are like me, you hate to pay taxes (at least the part that the government wastes each and every year). However, you probably also understand they are a necessary fact of life. Taxes pay for many important services such as our military to protect us all.

Anyway, this BLOG post is not about the pros and cons of federal income taxes – but I want you to understand them better than ever before. Of course, I am not a CPA, nor do I play one on TV but I think you will find this information helpful.

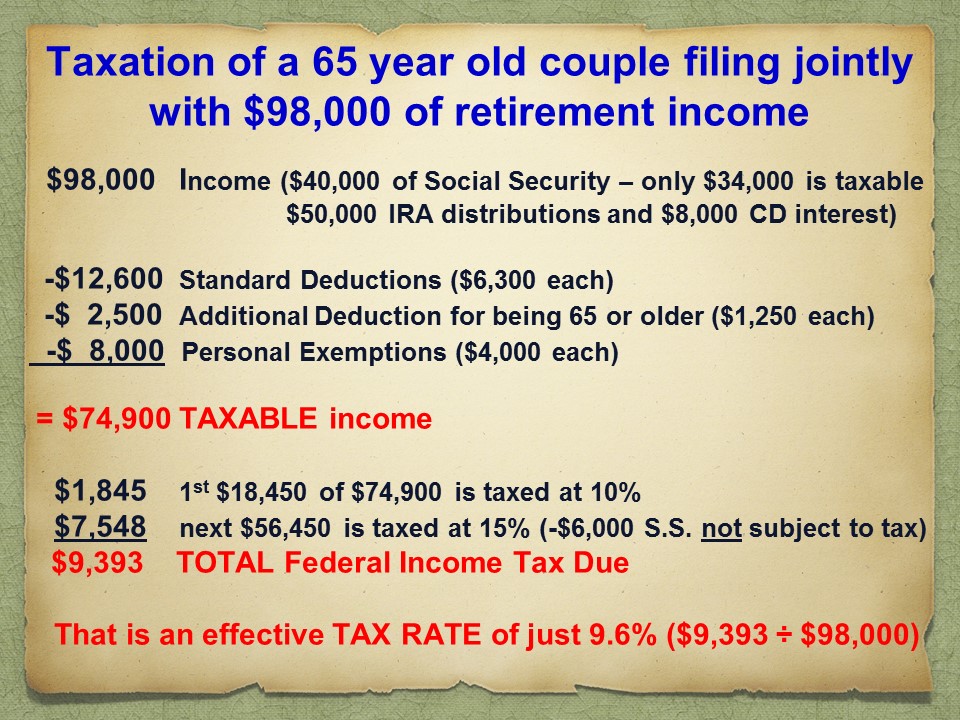

For 90% of Americans, federal income taxes are pretty low. And in this post, I’m going to show you how a couple age 65 or over (filing jointly) can have $98,000 in total income (2015) and pay an effective tax rate of just 9.6% to the IRS.

The 2015 tax brackets for a couple filing jointly show that the first $18,450 of TAXABLE income pays tax at the rate of 10%. Anything above that figure but below $74,900 of TAXABLE income pays 15% taxes on that income.

Of course, those who have taxable income above that amount pay 25% on those excess dollars up until $151,200 of taxable income. And so it goes (increasing tax rates) until you get to $464,850 of taxable income which income above that level gets taxed at current the maximum rate of 39.5%.

You should also know that couples filing jointly with over $250,000 of investment income pay a 3.8% Medicare surtax too. Unless someone has $10+ million or has a very high lifestyle, people who are actually subject to this extra tax, probably have a lousy CPA or financial advisor. There are legal ways to avoid that and other income taxes – but that is beyond the scope of this post.

Anyway, right now I’m going to show you how the couple above can enjoy $98,000 in total income (Social Security, IRA distributions, 1099 interest, etc.). The image below this text shows the math calculation.

So as mentioned above the top taxable income to keep within the 15% bracket is $74,900. But what about the deductions and exemptions, etc. that the IRS allows?

Let’s say that your home is paid off and don’t have enough tax deductions to itemize them — so you use the standard deduction of $6,300 each But since you are over age 65 you get to add $1,250 (each) to that figure which equals $15,100 for a couple. Then we get a $4,000 exemption per person from taxable income so another $8,000 does not get taxed.

In total we can add $23,100 of deductions and exemptions to our $74,900 where the 15% tax bracket stops. In other words, we can have $98,000 in total income and still be within the 15% top tax bracket.

But it can get even better. Let’s say that $40,000 of that income is from Social Security. At this income level 85% of Social Security is subject to taxation — but that means 15% (or $6,000 in this example) is TAX-FREE!

With the assumptions above, as you can see from the image below, our federal tax bill is about $9,393 which equals an overall effective federal tax rate of 9.6%.

Any income above the $98,000 (in this example) would be taxed at the next tax bracket of 25%, but less than 10% of retirees have that “nice problem”.

If some retirement income can come from a life insurance policy or a ROTH (both of which can be tax-free), someone can have even more income and still stay in the 15% bracket. That’s my personal retirement plan.

By the way, I have ignored state and local income taxes since they vary greatly in calculation methods and rates – from 0% to about 10%.

One more thing. For people filing as a single person, the math calculations are the same. The top of the taxable income for the 15% bracket, is half as that of married filing jointly ($37,450 instead of $74,900). However, the brackets

above 15% get worse (narrower) for single filers above the 15% bracket.

all the best… Mark