Warren Buffett was not very kind to bonds in his annual shareholder letter a week or so ago. Of course, readers of my weekly market updates and blogposts already know that I’ve been saying the same thing for a few years!

He wrote: “And bonds are not the place to be these days. Can you believe that the income recently available from a 10-year U.S. Treasury bond – the yield was 0.93% at yearend – had fallen 94% from the 15.8% yield available in September 1981?

In certain large and important countries, such as Germany and Japan, investors earn a negative return on trillions of dollars of sovereign debt. Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.”

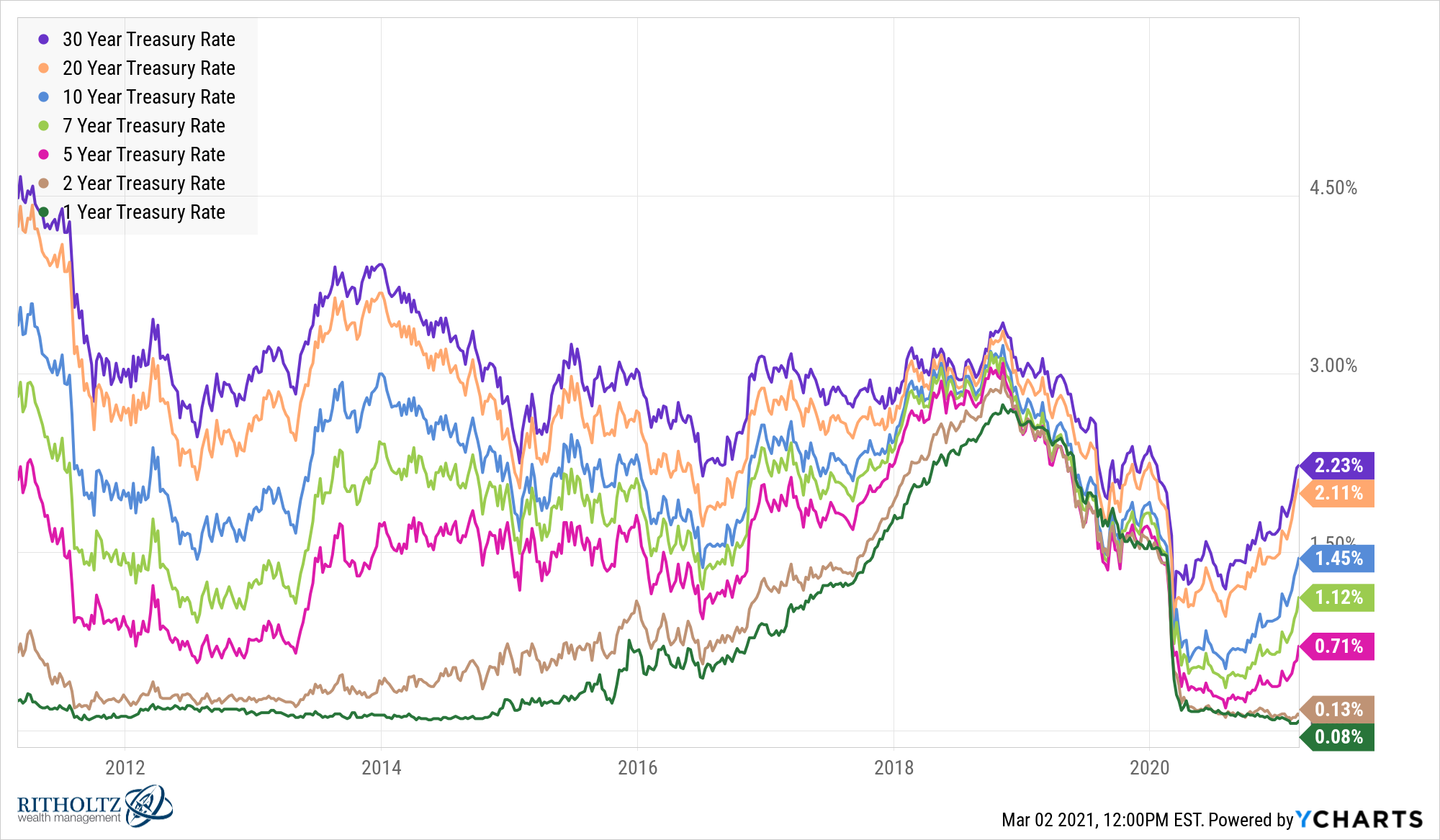

Below is a chart of bond interest rates over the last 10 years.

Even with the recent uptick in bond interest rates, the 10-Year US Treasury still yields about 1.5% – -which is less than most people believe is the real rate of inflation. And even that 1.5% is TAXABLE unless you hold the bond in a ROTH.

Renewed inflation fears could also send interest rates higher again. The new inflation story isn’t going away any time soon.

So many investors reach for more yield with longer maturities (20+ years). But again, the interest rate is closer to what actual inflation is now – and you still have the problem with taxes. The 30-Yr Treasury is about 2.3% now. Would you loan your money out for the next 30 years at only 2.3%? Not me.

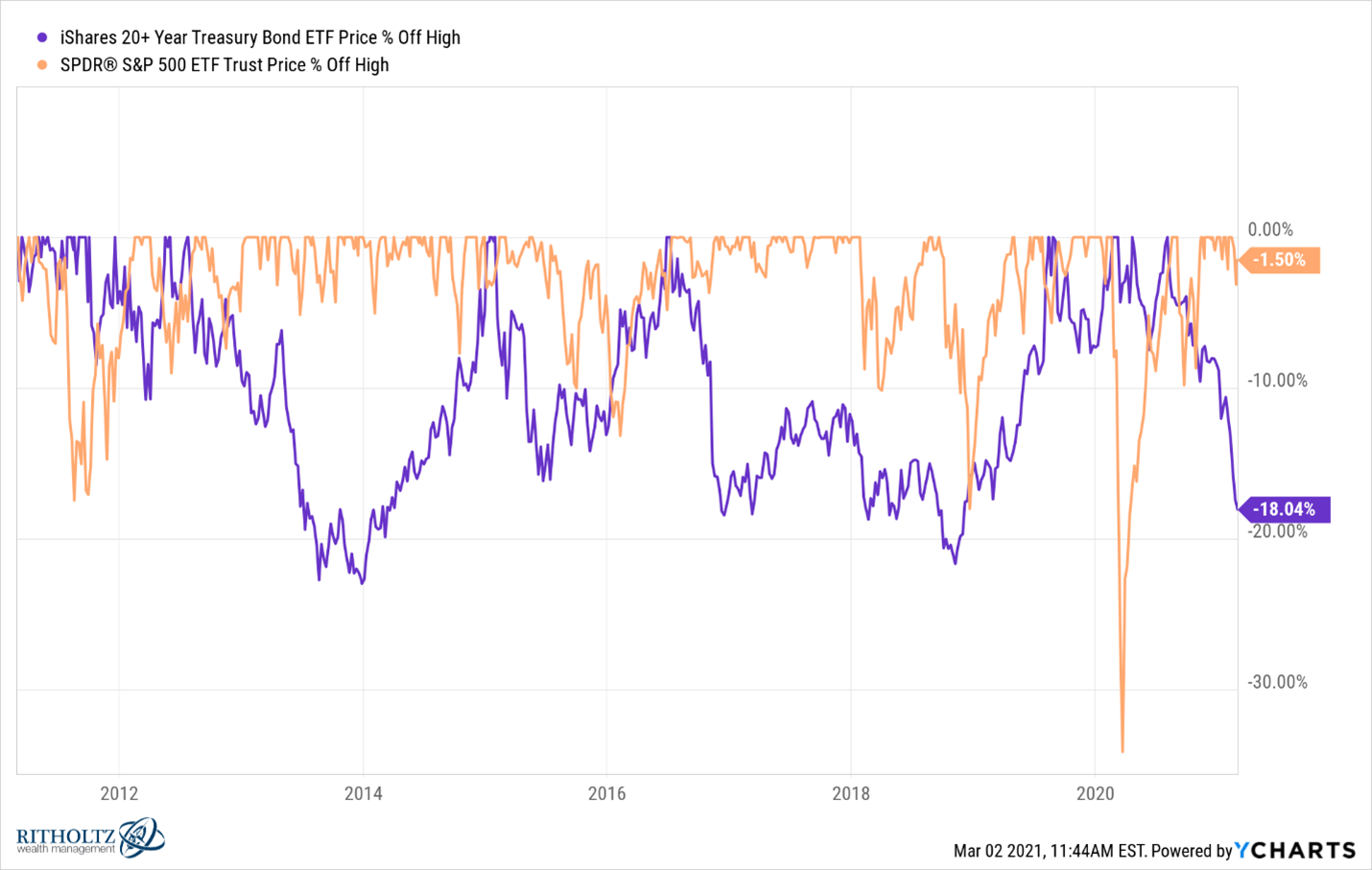

And these US Government bonds are safe, right? Well only if you hold them to maturity – which few individual investors do.

In fact, long-term Treasuries always have been and continue to be quite volatile. In the last 10-years, long-term government bonds (TLT) have had the exact same amount of double-digit drawdowns as the S&P 500 index (SPY). Take a look at this next chart. The purple is the 20-yr Treasury and the brown is the S&P500 index. Who would have thought??

That includes bond losses of 23%, 15%, 18%, 22% and 18% (the current drawdown).

U.S. Corporate bonds are down -4.3% so far this year as interest rates

rise higher.

Treasury bond investors are taking a lot of drawdown risk for such a little yield. That makes no sense at all. So, what are near-retirees and current retirees supposed to do?

Well, a number of my clients have switched out most of their bond portfolio for bond alternatives such as the buffer annuities I’ve written blog posts about (https://www.smartfinancialplanning.com/the-poor-mans-hedge-fund/) and structured notes (with coupons of 8%-15%) with about the same volatility as long-term bonds but with much greater yields. These notes typically have a 9 to 12-month maturity. No commissions – just our firm’s normal advisory fee.

Structured notes, although a $2 TRILLION business worldwide, are relatively unknown to most individual investors. However, our firm is one of the biggest players in the Registered Investment Advisory space with monthly offerings that our firm has negotiated directly with the likes of JP Morgan, Wells Fargo, Goldman Sachs, Bank of America, etc.

We suggest laddering the notes, buying 1-2 every month over a year.

Rather than be at the mercy of either potential rising interest rates (it’s already begun) or being stuck with the historically low-interest rates we’ve suffered through for a while, why not be proactive and take a smarter approach?

Between the buffer annuities, structured notes, and other bond-alternative strategies we can dampen the overall volatility and drawdown of your savings and produce very good potential long-term results.

Contact me for more information.

all the best… Mark